Bitcoin Valuation Analysis – Week 6

Bitcoin network valuation compared to last week,

- Top 100 richest Bitcoin wallets continue to increase their holdings approx. 140+Million$ price worth of Bitcoin added since last week.

- 0.44% growth in active wallets. Better compared to last week stats, still not a clear indicator of trend reversal anytime soon.

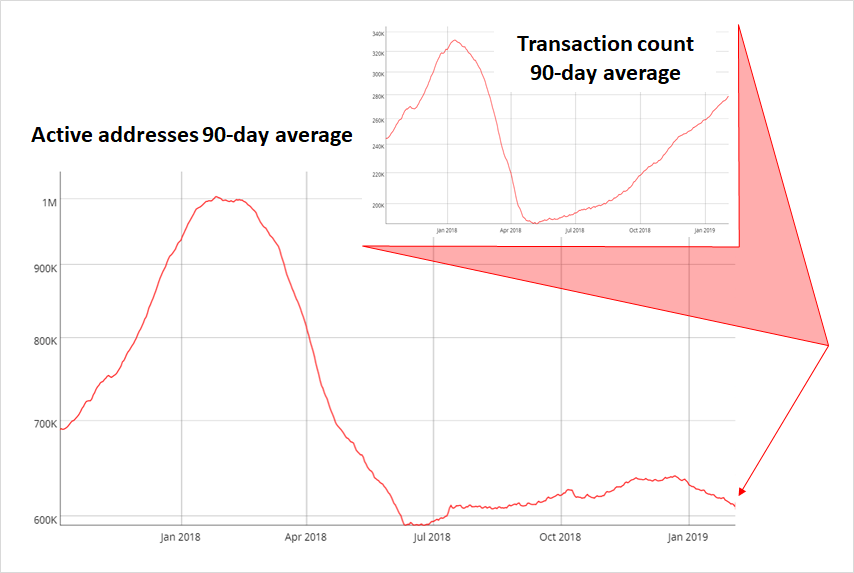

- The 90-day moving average analysis on BTC active addresses is yet to show any signs of recovery. The utility of Bitcoin Network remains a concern and continues to drop.

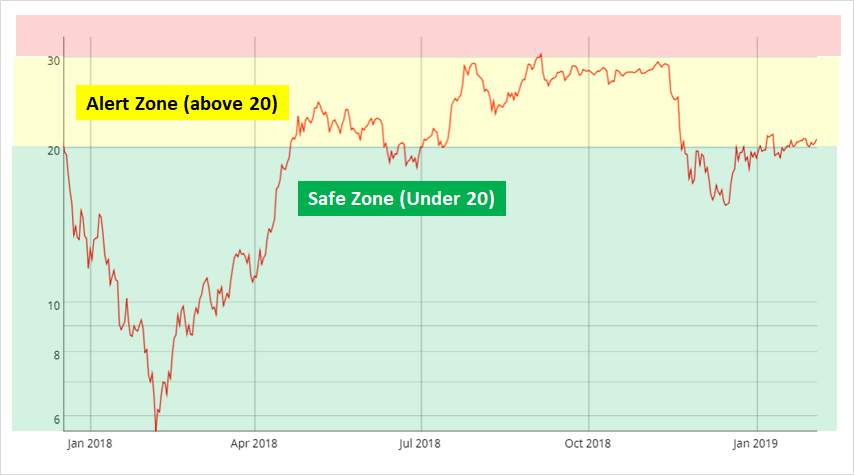

- NVA ratio remains in Yellow-zone i.e. network value is not supported by fundamentals and so Bitcoin market-cap may still be foreseen as overvalued.

Are Rich Increasing Their Holdings:

In comparison to last week, As of 3rd Feb 2019, we observed a 0.44% increase in active wallets activity. A slight increase in comparison to last week activity which was at 0.40%.

Wallets with Bitcoin in the range 10K-100K BTC continue to increase their holdings. Since last week added another 43,275 BTC to their wallets (refer below chart).

[visualizer id=”2412″]

Does BTC value support fundamentals

- Network utility with limited wallet in use

BTC active addresses stats is yet to show any confirmed signs of recovery. It continues its downtrend. As we reported in our previous article, this is the first time in the history of Bitcoin where the number of active bitcoin addresses has not grown after the fall.

Though the transaction count in the Bitcoin Network has increased after the drop, a limited number of wallets are transacting, mostly between each other indicating limited usage of the

- Fundamentals do not support current price valuation

Based on NVT, the current valuation of Bitcoin is still in the alert zone.

This indicates that the current Bitcoin price (market cap) is not supported by the underlying utility of the Bitcoin network and therefore may have strong chances of further price correction in near future until NVT settles and stabilizes in the green zone (refer Chart C).

The usage of Bitcoin for payments – the core intended purpose remains challenged.

Based on the above analysis, we believe that there is a high probability of Bitcoin price correction to come in the following week.

Definition:

– Active wallets: Active wallets are the number of unique sending and receiving BTC addresses participating in transaction on a given period.

– NVT: Network Value to Transaction is a ratio of market cap by transaction volume. All trading activity that happens on exchanges is speculative and so is not included in daily transaction volume.

The ratio explains how much current asset price is supported by the underlying utility of the network. NVT is a good indicator to detect bitcoin price bubbles when valuation is not supported by fundamentals.

– BTC range (X – Y): Number of wallets or addresses who have more than X but less than equal to Y amount of BTC.