Bitcoin exchange-traded fund (ETF) continues to be the most eagerly awaited decision from the U.S. SEC. In the U.S., eight firms have tried without success since 2013 to create a bitcoin ETF. SEC has been hesitant to approve the Bitcoin ETF, while other countries have embraced and launched it. Recently, Canada’s securities...

Crypto Trading

Elliott Wave theory is a method of technical analysis that Bitcoin traders look for recurrent long-term Bitcoin (BTC) price patterns. The Elliott wave theory says that a crypto asset such as Bitcoin (BTC) price movements can be predicted as they move in repeating up-and-down patterns called waves created by investor...

No chart pattern is more common in trading than the double bottom or double top. Double top and bottom patterns in the chart occur when the underlying crypto asset – Bitcoin price moves in a similar pattern to the letter “W” (double bottom) or “M” (double top). A double top...

Fibonacci retracement levels indicate where the price might find support or resistance. They are based on Fibonacci numbers and each level associates a percentage. Traders attempt to use them to determine critical points where an asset’s price momentum is likely to reverse. What Fibonacci Retracement Levels Tell You? Fibonacci retracements...

The Relative Strength Index (RSI), developed by J. Welles Wilder, is a momentum oscillator that measures the speed and change in the price movements to evaluate assets overvalued or undervalued conditions. How to read RSI: The RSI is displayed as a line chart that oscillates between 0 and 100 scale....

When a trader looks at the BTC price chart or any other crypto asset, it may appear to be completely random movements. This is often true, yet, within those price movements are patterns. Chart patterns are geometric shapes found in the price data that can help a trader understand the price action, as well...

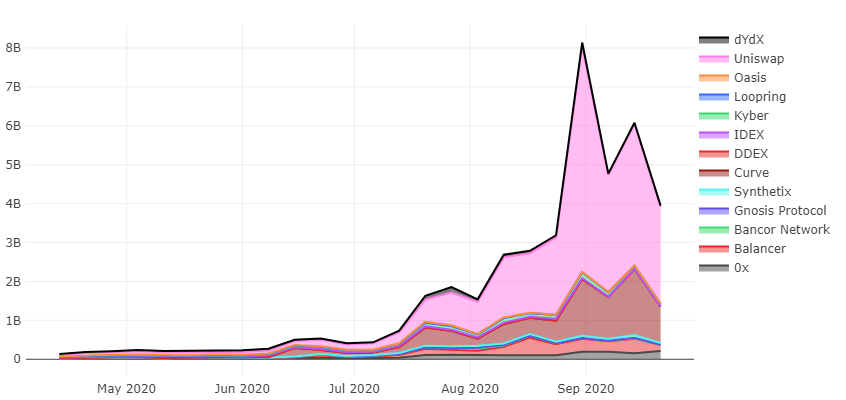

Investing in crypto assets has certainly evolved throughout 2020 and will continue to expand in the coming years. Today’s trading landscape is primarily dominated by a few large players, predominantly Coinbase, Kraken, Gemini, Bitstamp, Bitfinex, and Binance. While centralized trading has been widely popular, it’s not quite the new financial...

The importance of asset management firms is increasingly recognized in the world financial system. Despite the last few years of difficult markets and changing regulations, the asset management business is the most profitable with the highest returns on capital. Their profit margins are consistently higher than in most other sectors....

Initial Coin Offerings aka ICOs have been around ever since the blockchain was first developed. For those who don’t know, an ICO is a blockchain company putting their cryptocurrencies up for sale. This usually institutes thousands of traders buying as many coins as humanly possible from the company in hopes...