Over the next decade, Cryptocurrencies will Soar: Says Deutsche Bank

Until now, cryptocurrencies have been additions, rather than substitutes, to the global inventory of money. “Over the next decade, this may change”, according to Deutsche Bank research report.

Published this week, the bank predicts that the forces that have held the current fiat system together now look fragile and they could unravel in the 2020s. If so, it would lead to a backlash against fiat money and demand for alternative currencies, such as gold or cryptocurrencies could soar.

One of the key reasons highlighted in the bank’s report for the fall of fiat money is “record-high debt levels”.

Since 1970, virtually all money in existence has only had a value based on trust and, in particular, trust in governments’ ability to maintain its value. Politically it is always too tempting to create money when nothing is backing it. The forces which offset this risk now look fragile and may soon bust.

The end of fiat money:

So far total global debt has grown from 229% of GDP in 2000 to 305% in 2010 and then 319% today. Over the past decade, developed-world governments have contributed most of the new leverage. For example, US federal debt has risen from 34% of GDP in 2000 to 61% in 2010 and 78% now.

The latest economic indicators (such as negative yield, repo markets) seem to point to an acceleration of the economic slowdown and the risk of a looming global recession. Some even believe the debt crisis could even lead to depression.

Once it hits, it will affect citizens’ trust in the government/ central bank’s ability to oversee financial stability and blame central authorities for losing sights on the monetary/ fiscal policies. This could lead citizens to look for alternate money and demand for gold or cryptocurrencies to soar.

This trend is already visible in current times in places like Venezuela, Argentina where high inflation has lead citizens to adopt cryptocurrencies.

Another reason the report predicts why cryptocurrencies could become the 21st-century cash is their anonymity (or privacy feature). As per the report, “Nearly two-thirds of consumers prefer dematerialized to cash payments and a third are concerned by anonymity. These are the two things that cryptocurrencies do best.”

Cryptocurrencies: What needs to be done to make it mainstream

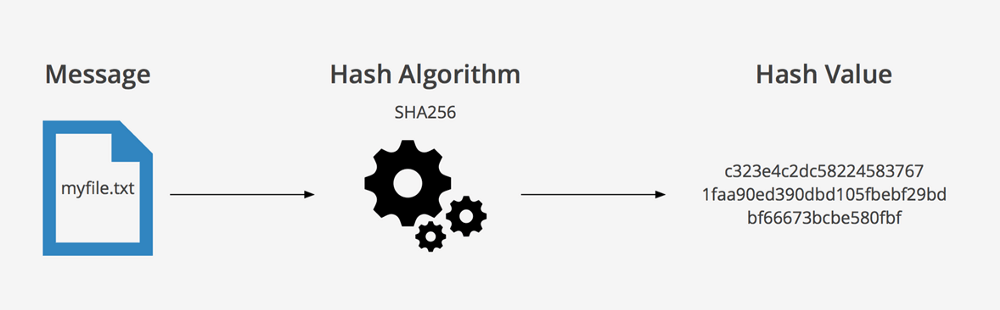

So far cryptocurrencies have not managed to take off as a means of payment despite their well-known benefits, such as security, speed, minimal transaction fees, and ease of storage.

Looking ahead, this situation may be different if blockchain start-ups overcome regulatory hurdles. Once it happens, it would broaden citizens’ interest in cryptocurrencies and thereby, raise the potential to eventually replace cash.