Why Bitcoin Broke The Support Level

Bitcoin support level continues to break and remains highly unpredictable. There are no takers for Bitcoin despite a huge fall from its peak 20,000$ to 3,400$. Maybe investors are moving money back to traditional safe-haven ‘gold’ or believe that blockchain “is no better than excel spreadsheet”.

The following article lays down reasons based on facts/ statistics AND NOT BASED ON someone’s opinion whom we call Z.E.B.R.A. (Zero Evidence But Really Arrogant).

So why Bitcoin broke its previous support level of 3500$?

Significant number of whales sold their holdings

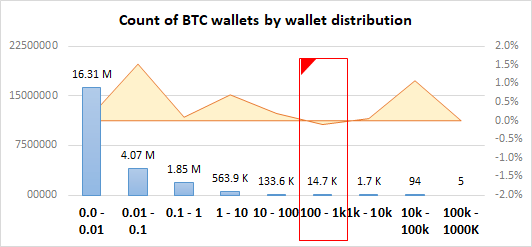

For our first stats, we are using data on wallet distribution based on wallets BTC holding. The categories in the x-axis of graph A and B shows this distribution. So, for example, the first bar in graph A represents the number of wallets which hold BTC in the amount range of 0 – 0.01 BTC.

Compared to last week, a 0.4pts increase was observed in the number of active BTC wallets. The highest increase (by 1.5pts) was seen in the wallet category where the bitcoin is held in the range of 0.01 – 0.1 BTC.

Noteworthy to mention, 1 wallet joined last week in the high ranks of whale group. But there is a significant decrease in the number of wallets who previously held bitcoin in the range of 100-1k BTC i.e. drop by 0.4pts or 15 wallets less in this category compared to last week stats.

We also observed a major sell-off (Graph B) by holders who previously held (last week) bitcoins in the range of 1k-10k BTC in their wallets.

So Why this behavior?

BTC valuation considered overpriced

It is unclear why these wallets in the range of 1k-10k BTC have largely sold BTC. Maybe our next analysis on Network value of transactions could give some insights.

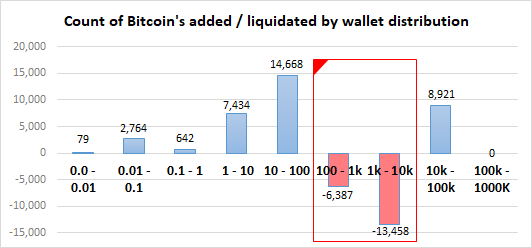

What is Network Value of Transaction (NVT)? NVT explains how much current asset price (market cap) is supported by the underlying utility of the network. In the case of Bitcoin in the form of on-chain transaction volume.

Remember the transaction volume in NVT takes into account only on-chain transactions. Therefore, all trading activity that happens on exchanges is speculative and so is not included in daily transaction volume.

NVT is a good indicator to detect bitcoin price bubbles when valuation is not supported by fundamentals. So in simple terms, if a trend falls in the green-zone indicates a healthy valuation of the asset.

Given the current pattern (Graph C), The current valuation of Bitcoin is still in the alert zone. Therefore, we

Graph C – NVT used here is based on Kalichkin’s recommended 90 days moving average for transaction value.

Note: NAV used here is based on Kalichkin’s recommended 90 days moving average for transaction value. We at Crypto Purview research team believe that transaction value is not the exclusive & only representation for how users derive a value for utility. However, Kalichkin’s NAV calculation closely represents bitcoin price correction over time.

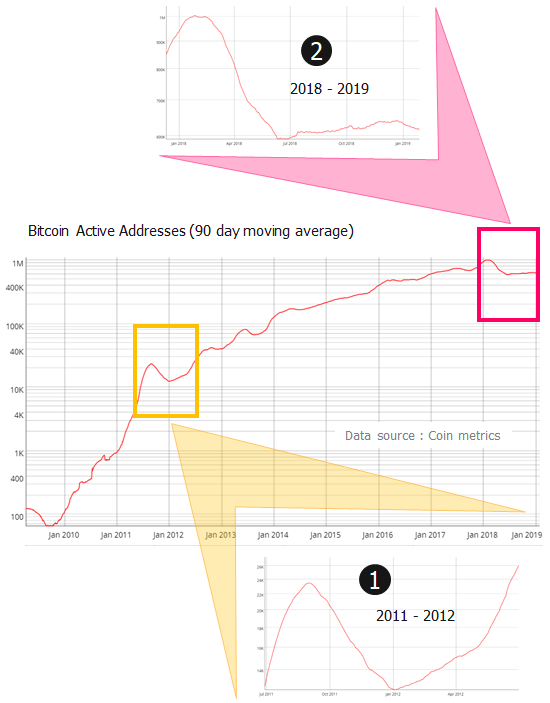

To confirm this pattern, we looked at the growth trend in Active Bitcoin Addresses (Graph D).

Little to no growth in active BTC wallets (less utility of network)

Note: The comparison graph (1 & 2) was approx. selected and so is not an exact match of duration period compared.

The downtrend (Graph D) in 2018 – 2019 is first of the kind where a number of active bitcoin addresses have not significantly grown after the fall.

There could be several reasons contributing to slow to limited growth in active bitcoin addresses. Probable reasons could be :

- Harsh criticism by media/ influencers.

- Reduced count of miners due to increasing hash rate, making bitcoin mining not profitable.

- BTC breaching all support-levels.

- ETF dis-appointment.

- Don’t believe in Blockchain.

Will valuation improve:

The developments planned in 2019 by projects Lighting Network and RSK will strengthen Bitcoin network and increase it usage. Also, increasing number of countries with high inflation or affected by regulation have turned to Bitcoin as alternate reserve.

Big enterprises- Amazon, Samsung, Facebook etc have already built blockchain/crypto related service products and soon many others will follow.

Increasing demand from consumers has lead enterprises to explore blockchain technology to transform traditional business model and introduce blockchain based products or services which will help organizations to be more transparent, secure and efficient.

Given the above development, We believe the support for Bitcoin and blockchain will grow in 2019.