Why the central banks are rushing to create a digital currency

Digital innovation is transforming economic activity by creating simplicity and accessibility. In recent years with technological advancements, a shift in general public payment patterns has emerged. Less use of cash is opening up a number of questions concerning traditional money (cash) continuity in the future. This has led the central bank to start considering how best to take advantage of modern technology.

The latency in the traditional system has given rise to mobile payment popularity. Money is sent by entering the phone number of the receiver. Regardless of which banks the participants use, the money shows up instantly in their bank account. And no need to create a new account, just connect your phone number to your existing bank account.

Why the rush for creating digital currency:

Much of these new payment systems are privately-owned. For instance, in countries like China, digital wallets like Alipay and WeChat Pay have revolutionized the delivery of banking products. Their ease of use and accessibility have caused mobile payments to soar 12-fold to $24 trillion in 2018 and have become a popular choice for gateways to financial services such as wealth management, banking, commerce, and personal finance.

The rising use of such payment systems has decreased usage of central bank-issued cash (or fiat), putting more power in the hands of these privately-owned companies. Since this money is actually a claim, a promise to give you central bank money on demand, there is a risk involved – what if they lose users’ money. This worries the central bank. Therefore, it is important that the general public has direct access to central bank money.

Important: The public only has access to central bank money in the form of notes and coins while the numbers in your savings account are the digital version issued by the banks themselves. So when you use your savings account to transfer money to your friend’s account, the resulting balance is a liability for the bank. It represents the amount the bank owns to the customer. So what if private-bank lose this money?

Read more: How Banking System Operate And Manage Our Transactions

Central bank solution ‘Digital Innovation’:

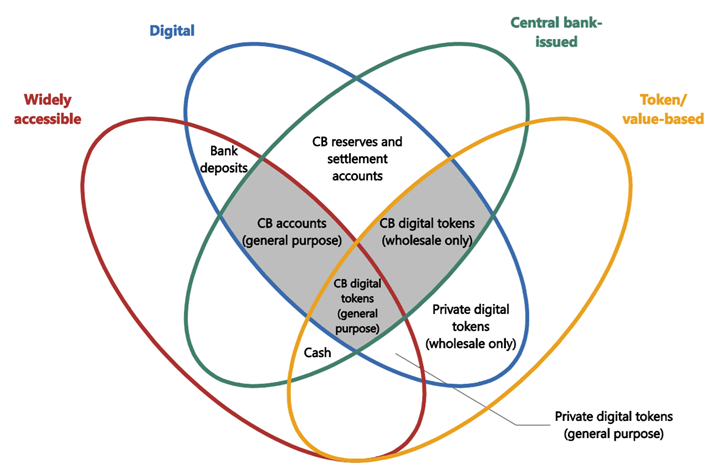

To respond to these risks, the Central Banks are considering to issue the digital version of fiat currency which can be instantly and safely transferred between individuals. As per the research published by Bank for International Settlements (BIS) in Jan 2019, across the world, central banks are reportedly thinking about how new central bank digital currency (CBDC) could replace traditional money.

The study shows that over 40 countries have developed or are looking into developing a digital currency. For instance, Sweden is working on an ‘e-krona’ project and China is planning to launch a digital version of the yuan currency later this year or in early 2020.

Important note: The creation of central bank digital currency (Wiki: CBDC) does not imply by means of distributed ledger technology.

Much of the central banks who jumped early to adopting digital innovation, including Sweden, Uruguay, China, etc, have considered developing a platform that allows maintaining transaction records of the digital currency owners. This means the central banks will have closer oversight over money flows using the digital currency. The distribution of digital currency is managed through a 2-layer approach in which third-party payment service providers held an equivalent value of the traditional currency in a central bank account, collect digital currency and then distribute it to the general public.

This approach was first adopted by Sweden, Uruguay and now China. Recently, the U.S. Federal reserve’s job posting suggests the central bank is considering to digitally innovate their retail payment system.

Use of distributed ledger technology (DLT) by central banks to broader financial inclusion goals:

Central banks tasked with overseeing the nation’s monetary policy, ensure the nation’s financial and economic stability, and act as a clearing-house for the inter-bank transactions are very cautious and put a great deal of attention to implement any technology or solution.

As per the research carried out by BIS, 70% of respondents (total 63 surveyed) are currently (or will soon be) engaged in central-bank digital currency work. At this point, half have moved from research and theoretical to more hands-on proof-of-concept tests. Many of these are attempting to replicate wholesale payment systems using distributed ledger technology. A central bank-issued digital currency for wholesale purposes is available only for commercial banks and institutions allowing transaction settlement between them instantly with no central bank involvement.

China is a recent case which is following the same foot-steps. As many as seven to eight institutions will take responsibility for distributing China’s digital currency to the general public. China’s popular mobile payment platforms – Tencent, WeChat and Alipay are also expected to integrate digital currency into their platform.

Such an arrangement is expected to create competition among the distributing institutions to provide the best service using the new form of money. In the words of China’s head of the digital currency research institute, Mu Changchun, “who is more efficient, who can provide a better service to the public – they can survive in the future”.

Countries that created their digital currency by other means (not DLT technology) are also using third-party payment service providers for the distribution of digital currency. These providers may use distributed ledger technology (DLT) for providing better service to remain competitive. Central banks of these countries have not ruled out the use of distributed ledger technology (DLT) in the future.

Comments are closed.