MoneyGram moves 10% of Mexico-U.S. transactions using Ripple’s ODL

MoneyGram, one of the world’s largest money transfer companies currently processes 10% of its U.S-Mexico transaction volume through Ripple’s On-Demand Liquidity (ODL) platform. Ripple’s On-Demand Liquidity (ODL) platform leverages on XRP cryptocurrency as a bridge for cross border payments.

MoneyGram Chairman and CEO Alex Holmes announced the news at Ripple’s annual conference Swell 2019, adding that the company also plans to expand Ripple’s ODL usage in four more corridors by the end of this year.

“What I love about ODL is that we’re completely at the forefront of this technology. We’re able to settle billions of dollars in seconds. The magic really comes from pairing MoneyGram transactions with Ripple’s ODL”, Holmes said.

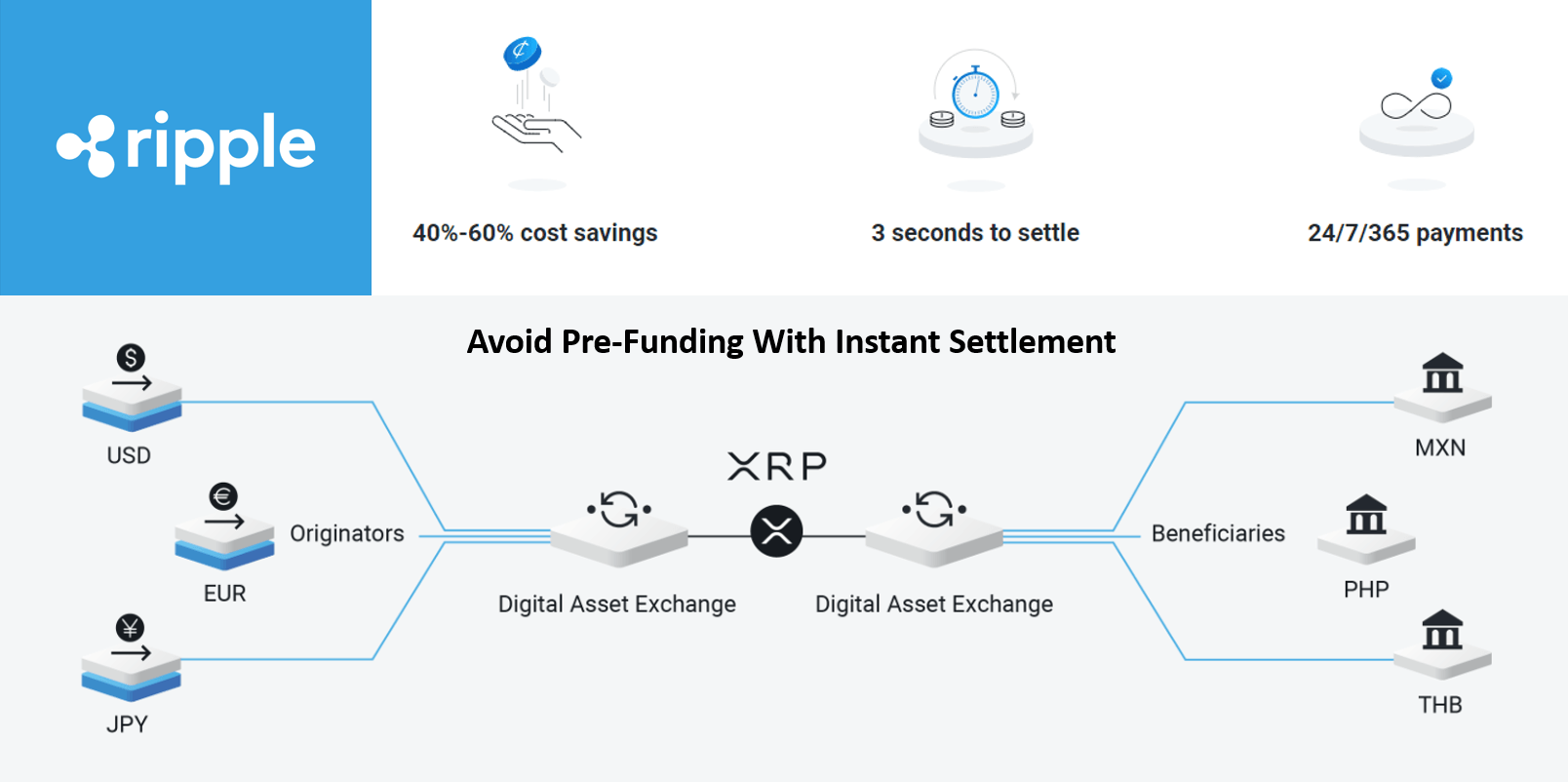

Since the launch of the ODL last year, the payment corridors have expanded from Mexico and the Philippines to include Australia, with Brazil planned by end of 2019. Using Ripple’s ODL, customers can avoid the costly endeavor to hold pre-funded accounts in destination currencies, making it an ideal solution for international payments, especially in emerging markets.

Some of the other notable customers using Ripple’s ODL include goLance, Viamericas, FlashFX, and Interbank Peru. In a recent press release, Ripple shared that the customer interest is increasing in their offering and there have been more than 7 times transactions using ODL from the end of Q1 to the end of October 2019.

What problems Ripple’s On-Demand Liquidity (ODL) platform solves:

For routine domestic transactions like transferring from your savings account to your friend’s bank account, the process is simple. These transactions are approved against account balances in a single currency held by each party (or bank). The challenge increases when your friend’s bank account is in another country.

Cross-border transactions face regulatory hurdles and delays of 3 – 5 days. Additionally, the transaction has to go through converting one currency to the destination country’s native currency. As a result, financial institutions held accounts in the corresponding banks and hold balances with each other in local currency to improve liquidity. The amount held at other banks adds cost and risk. What if the bank goes bust.

Read more: How Banking System Operate And Manage Our Transactions.

According to a 2016 McKinsey report, there are approx. $5 trillion dollars sitting dormant in these accounts around the world. The cost of holding these accounts is one reason why only a handful of banks can process global transactions.

Ripple’s On-Demand Liquidity (ODL) platform removes this burden of maintaining accounts worldwide. Instead, Ripple’s customers use XRP in their payment flows to provide liquidity solutions for their cross-border payments. Catalyst Corporate Credit Union, MercuryFX, Cuallix and now MoneyGram have publicly announced their use of XRP for cross-border payments.