VanEck-SolidX Withdraws Its Proposal for Bitcoin ETF

VanEck-SolidX withdraws its application for the Bitcoin ETF proposal just a month before the scheduled date for the SEC to give the final decision on the proposal.

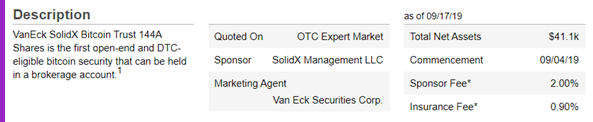

Earlier this month, VanEck-SolidX launched limited shares of Bitcoin Trust 144A as a testing ground available only for qualified institutional buyers with a shorter holding period. Since its launch, the firm managed to sell only 1 basket (for 4 BTC) of Bitcoin trust shares.

The firm is yet to give any official statement for the reason for withdrawing. Gabor Gurbacs, VanEck’s director of digital asset strategies said in a tweet:

“We are committed to support Bitcoin and Bitcoin-focused financial innovation. Bringing to market a physical, liquid and insured ETF remains a top priority. We continue to work closely with regulators & market participants to get one step closer every day.”

Another Bitcoin ETF proposal from Bitwise Asset Management filled in the beginning of this year is awaiting for SEC decision on 13th Oct. The SEC had postponed the decision on VanEck-SolidX ETF as well as Bitwise’s ETF application several times.

Recently, in an interview with CNBC, SEC Chairman Jay Clayton said that concerns remain on lack of safe custody options and largely traded on unregulated exchanges, therefore, worried that prices are subject to significant manipulation.

Comments are closed.