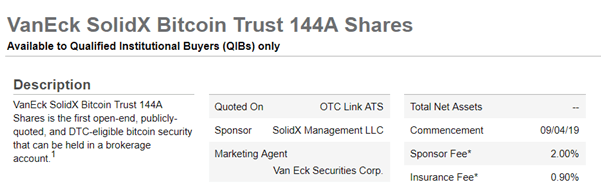

VanEck SolidX Offers Institutional investors limited version of Bitcoin ETF

As per the Wall Street Journal, VanEck SolidX is trying a workaround to prove SEC that Bitcoin ETF can work. As per the news report, the two companies are planning to sell limited shares of a Bitcoin exchange-traded fund to institutional buyers.

The companies are employing a rule 144A which exempts the Securities and Exchange Commission (SEC) restrictions (Securities Act of 1933), thereby allowing trade of Bitcoin ETF shares privately. Only qualified institutional buyers with a shorter holding period (usually 6 months or a year) can purchase these investment shares.

The sale of VanEck SolidX Bitcoin trust shares is expected to begin on 4th Sept 2019. It would be offered to qualified institutional buyers like brokers, banks and hedge funds.

Before a security can be offered to the general public, the Securities Act of 1933 stipulates that the issuer must register it with the SEC and provide extensive documentation through a filing with the agency.

Rule 144A modifies SEC stipulation. It was drawn up in recognition that more sophisticated institutional investors may not require the same levels of information and protection as do individuals when they buy securities.

The Rule provides a mechanism for the sale of privately placed securities that does not require an SEC registration. This mechanism helps to create a more efficient market for the sale of those securities.

Crypto enthusiasts have been waiting for a long time to see SEC approval on Bitcoin ETF. SEC has postponed the decision on VanEck and SolidX Bitcoin ETF multiple times.

Hope that this limited version of VanEck and SolidX Bitcoin trust shares will help the U.S. SEC to make a decision on long-awaited Bitcoin ETF proposal.