Gambling dApps Losing Fame; DeFi New Crowd Favorite

2018 was the momentum year for dApps usage. At the beginning of 2018, DEX were the key contributors by transaction volume and proved decentralized exchange as one successful use case for dApps.

Later gambling apps dominated much of the platform use. At its peak, Gambling apps contributed the highest transaction volume (~85% in Q1 2019) and the one with the most active user base, however, the tides changed in Q2 2019.

Comparing gambling dApps transaction volume in Q3 2019 Vs Q1 2019:

- Transaction volume in gambling category apps dropped by more than 40%.

- WINk, a popular gambling app in Tron platform formerly known as TronBet experienced a 50% drop in the transaction volume. Despite the drop, currently, WINk leads in the gambling category with more than 65 Million$ in 7-day transaction volume.

Stats of most popular gambling apps in Q1 2019 and Now:

| Platform | ETH | EOS | TRX |

| Application name | FCK | EOSJacks | TronBet |

| 7-day transaction volume in March 2019 | 6 Million $ | 23 Million $ | 125 Million $ |

| 7-day transaction volume in August 2019 | 0 Million $ | 1.2 Million $ | 65 Million $ |

With increasing BTC price, the focus of users is back to trading activity and so, benefiting the DEX most throughout 2019 (percentage-wise). [inlinetweet]The need to expand the investment portfolio has also brought focus to lending/ borrowing, making decentralized finance (Defi) projects crowd favorite.[/inlinetweet]

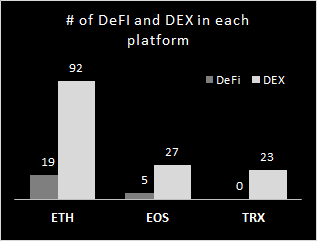

ETH is now home to many DEX and Defi applications, and the only platform with the most diverse applications.

[inlinetweet]Nearly 90% of ETH dApp transaction volume comes from Exchange and Defi applications.[/inlinetweet]

Decentralized Finance, also known as Defi offers a compelling value proposition whereby, individuals or institutions can easily and quickly access borrowing or lending capital without the need for a trusted intermediary.

List of top Defi projects:

Using ETH platform:

– Lending projects (by assets locked. Source: dapp.review):

(1) MakerDAO – 310 Million$

(2) Compound – 88 Million$

– Uprising De-Fi project: NEST, a digital asset mortgage lending platform with 5 Million$ daily transaction volume.

– Derivative exchanges (by assets locked. Source: dapp.review):

(1) Synthetix – 27 Million$

(2) dYdX – 10 Million$

Using EOS platform:

EOSRex one of the largest Defi platforms in EOS enables users to borrow and lend EOSIO resources (e.g. CPU and NET Bandwidth). As per the stats from dapp.review, [inlinetweet]EOSRex has the largest collateral value locked i.e. 565 million$ worth EOS.[/inlinetweet]

ETH platform shines again

[inlinetweet]Given Ethereum’s most mature ecosystem and wider distribution, it has grown to become one of the main choices for Defi developers[/inlinetweet] and established institutions are starting to move over to the Ethereum network.

Recently, Bittrex exchange switched Tether (USDT) from the OMNI network and re-issued as ERC-20 standard on the Ethereum network and In mid-July, Huobi exchange announced it will transition its HUSD token from its current platform to an ERC-20 standard.

Comments are closed.