For the first time in three years, the most popular cryptocurrency in the world has broken the $19,000-mark amidst a pandemic, hitting an all-time high of $19,857 in November. The value of Bitcoin has risen by as much as 177% this year, with a 40% surge in November alone, a rally seldom reached by traditional assets in a single month. The so-called ‘digital gold’ has been looking fairly stable so far in the last three months, without a single daily drop of more than 5%, which is quite impressive for a commodity known for its volatility.

Meanwhile, real gold is not comparably faring well in the midst of a global health crisis, with a drop of 10% since August. Today, one Bitcoin can buy over 11 ounces of gold. Co-founder of cryptocurrency exchange Gemini, Cameron Winklevoss, believes in the potential of Bitcoin to unseat the precious metal in value storage, with the possibility of reaching prices as high as 25 times its current mark. Gold also has become less of a priority for investors at the moment, as they start to buy shares in businesses expected to recover soon from the global economic slump.

What is Causing the Current Rise of Bitcoin?

Although Bitcoin has now become more attractive to investors, outshining both gold and stocks, it takes us back to a similar historic event in 2017. CNBC reported how Bitcoin shot up to as high as $19,340 but came crashing down the next day by more than 20%. Some argue that the rally this year is different as there is less hype around the Bitcoin movement, yet it is looking more sustainable despite the expected minor pullbacks.

Of course, it has not been easy for Bitcoin in 2020. FXCM details how the safe-haven status of the cryptocurrency was questioned a lot over the past year, especially as the price of Bitcoin fell from above $10,400 in February to just under $4,120 in March. This drop came alongside a similar movement in the stock market, which raised doubts over its ability to hedge against stock losses. But as it turns out, Bitcoin still outperforms stocks due to more favorable price action, a huge increase in institutional demand, and the continuous belief of investors in its exponential growth potential.

With the original Bitcoin code embedded with only a 21-million coin limit, its rarity does not necessarily increase its value, but it increases the demand, due to the belief that opportunities for obtaining it keep dwindling over time. And despite more traditional assets being around for much longer, there is somewhat enough familiarity in Bitcoin to breed buying confidence as its popularity keeps growing.

The emergence of stable coins has also contributed to this familiarity as they have more price stability. These cryptocurrencies have been also backed by governments and corporate groups, making them more legitimate. As the pandemic forces the worst annual drop of the dollar since 2017, Bitcoin is on the rise, shrinking the cost of owning Bitcoin compared to bonds and bucks. Cryptocurrency has also become more mainstream as more investors and legitimate institutions start considering digital currency as a potential defense against currency devaluation.

What is Next for the Biggest Cryptocurrency in the World?

Previously, our Insights section presented possible scenarios of Bitcoin adoption, which include its potential as ‘digital gold,’ serving as a safe haven for investors whenever stocks and bonds are in free fall. The negative view of governments about cryptocurrencies, including Bitcoin, may improve as they seem to have become a safer alternative for foreign reserves and assets in times of currency devaluation and economic turmoil.

Banks have been monitoring the demand for Bitcoin so they can act quickly in offering it to customers as an alternative investment asset. Bitcoin also provides faster cross-region fund transfers for lower fees, which grows the interest among business owners with an urgent need for real-time payments.

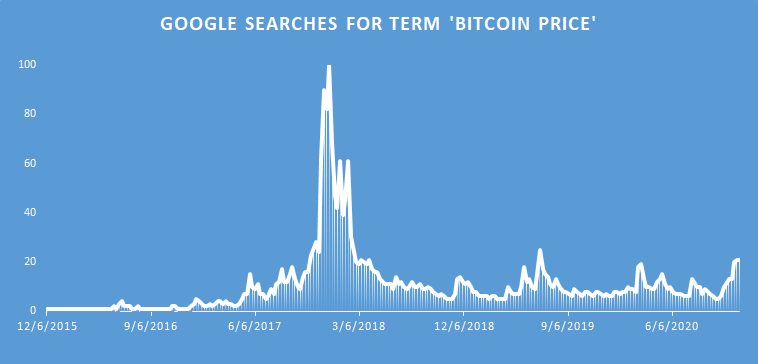

General interest in the cryptocurrency has risen alongside its current value as well, with Google searches of keywords “Bitcoin price” hitting an 18-month high. Although compared to its search return value of 100 in Google Trends three years ago, when Bitcoin last hit the current price mark, it is still low today at 21. This data can validate analysts who say that the rally this year is mainly driven by increased institutional participation, which is expected to keep increasing in the coming years.

Cryptocurrency exchange Giottus co-founder and CEO, Arjun Subburaj, believes this is just the beginning. “We will have the mother of all bull runs in 2021 when the cryptocurrency gets adopted by masses and cryptocurrencies go mainstream,” he confidently claimed in an email.

Over the next decade, the Deutsche Bank predicts fiat money will fall due to record-high debt levels, leading to an increase in demand for alternative currencies. High inflation in countries like Venezuela and Argentina has already led to cryptocurrency adoption among citizens. The anonymity of these digital currencies is also another reason why the said institution predicts cryptocurrencies to become the cash of the 21st-century.

Despite the security, speed, low transaction fees, and storage convenience, Bitcoin and other cryptocurrencies are still not mainstream. Yet, once blockchain startups have overcome regulatory obstacles, the interest of the majority will grow even more until it could eventually become the next mainstream form of finance.