Update on Facebook’s Libra project

Since the announcement of Facebook’s plans to launch a cryptocurrency project, Libra, it came under fire from policymakers around the world. Governments/regulators around the world are concerned that the new money system could endanger their monetary sovereignty and users’ data privacy.

The events that followed after the announcement made one thing clear to Facebook that they are not welcome. They can’t just show up and say we’re launching a new product. Lesson learned and now the firm plans to take a more consultative approach.

Recently in an internal Facebook meeting, CEO Mark Zuckerberg expressed his thoughts about the public scrutiny that Libra has experienced. He believes public hearings tend to be a little more dramatic while private meetings with regulators are often more substantive and less dramatic.

CEO Mark Zuckerberg comments on Libra’s rocky rollout

In a leaked Facebook’s internal meeting audio recording obtained by The Verge, CEO Mark Zuckerberg reiterated Libra’s aim of creating the “ability for people to send money hopefully as easily as you can send a photo or other content across the world to different folks”.

He added that by the time Libra is launched, we expect 100 or more companies as part of its ecosystem. Also stated in the Libra’s milestone, the team expects to have 100 partner nodes online by mainnet launch.

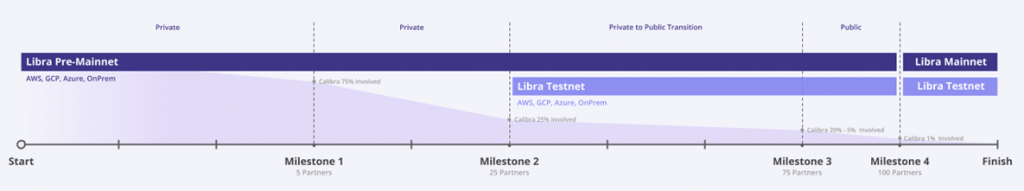

Libra Associaton publishes milestones to mainnet launch

Recently Libra association published their milestone to mainnet launch. Starting with pre-mainnet, the team expects to have at least 5 partners to host full nodes. Each node will be run on a mixture of on-premise and cloud-hosted infrastructure. The pre-mainnet environment will enable partners to test the stability and reliability of the Libra network.

As the project progresses towards the mainnet, it is necessary to bring more nodes online. This will create a wider, diversified infrastructure that will provide a more resilient network. Therefore, the team will focus on onboard as many as 100 partner nodes by mainnet launch.

So far Libra association has 28 founding members and the team expects at least 5 to join their pre-mainnet environment. However, the ongoing government and regulatory scrutiny have made some of the founding members to re-evaluate their position.

Payment firms are hesitating to formally sign Facebook’s cryptocurrency project

The Libra association is asking the 28 founding members to reaffirm their commitment to the project. Given the regulatory concerns over Facebook’s cryptocurrency project and the perception that social network hasn’t behaved responsibly when it comes to handling user data and privacy, payment firms are reevaluating their position.

Visa, Mastercard, PayPal, and Stripe are concerned that formally signing and accepting membership in Libra association may affect their so-far positive relationships with the regulators.

Way forward

Getting Libra members formally commit indicates that Facebook is pushing forward its plan, even after several push-backs from the governments. Expect the update on the first wave of Facebook’s Libra Association members in a few weeks.

Responding to the rumors of payment firm reevaluating their involvement in Facebook’s Libra project, David Marcus, Facebook’s Libra project executive said in a tweet that “I have no knowledge of specific organizations plans to not step up”.

Given the big question of whether Facebook could be trusted to expand into financial services, the focus of Libra executives will be to soon tie the loose ends with the regulators. The team is meeting the regulators around the world to understand their concerns/ feedbacks and incorporate them into their design. It is unclear to what extent regulatory concerns can be addressed, do expect Libra launch in select few countries only.

To hinder Libra’s success, Eurozone members agreed to pursue a tough regulation should Libra seek approval to operate in Europe. Additionally, Eurozone members are considering to step-up plans for launching a European Central Bank-backed digital currency similar to China’s state-backed digital currency. Recently two U.S. members of Congress, French Hill, and Bill Foster asked the Federal Reserve to consider developing a digital currency.

Comments are closed.