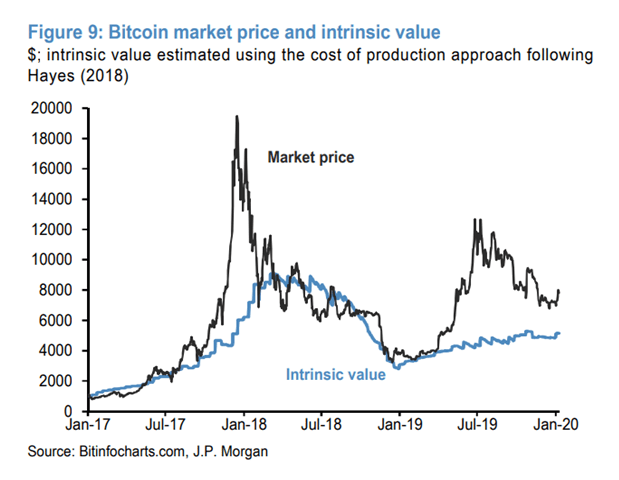

Bitcoin’s realistic value remains below market price

According to the JPMorgan analysts, Bitcoin’s realistic value remains below the market price suggesting a downside risk. Since the peak of Bitcoin’s price in 2019, the market price has declined by nearly 40% while the intrinsic (realistic) value has risen by around 10%. The gap has not fully closed yet and therefore, a further decline in Bitcoin price is expected.

JPMorgan calculates intrinsic value by treating Bitcoin as a commodity and looking at the marginal cost of production including computational power employed and the cost of electricity.

In another analysis from Woobull, the charts show Bitcoin’s realized price around $5,500 while NVT ratio, a signal that provides more emphasis on predictive signaling ahead of price peaks, suggest Bitcoin at overbought levels.

The CME Bitcoin futures open interest charts from Skew.com show an increasing trend, meaning a large number of futures contracts have not been exercised/squared off. In simple terms, institutional investors’ money is flowing out of the futures market.

For reference: the Following table shows how to interpret Open Interest with respect to price for trading.

| Price | Open Interest | Interpretation |

| Rising | Rising | Bullish |

| Rising | Falling | Bearish |

| Falling | Rising | Bearish |

| Falling | Falling | Bullish |

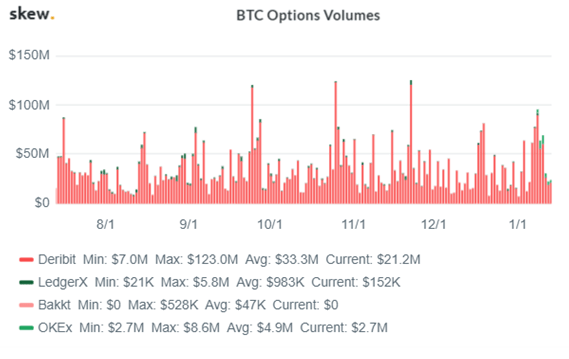

Bitcoin Options – A game-changer?

Many anticipate the launch of CME group Bitcoin Options on Jan 13 as a game-changer. However, it is unlikely the new contract will immediately increase institutional interest in Bitcoin-related contracts. More likely may turn out that CME’s existing customers of Bitcoin futures (or users from other competitive platforms) will experiment with or shift to CME’s Bitcoin Options.

Even Bakkt who launched their Bitcoin options last month has a small open interest in the offering. Based on the data from exchanges Deribit, Bakkt and LedgerX, the average daily volume for Bitcoin options in the past year has been around $20-30 million. Therefore, the demand for Options is questionable.

Technical analysis:

As shown in the below chart Bitcoin price (BTC), break above the upper range of the descending channel has remained a challenge for weeks. It seems, for now, the $8300-$8500 is acting as strong resistance for Bitcoin.

Given the continued lack of volume to break the resistance, it’s highly likely for Bitcoin to fall near the $5500 – $6000 level. A drop near $5500-$6,000 could be the bottom for 2020.

What’s Next:

Bitcoin halving, the event, expected in May 2020, slashes the number of new coins awarded to bitcoin miners by half to solve complex maths puzzles, limiting Bitcoin supply in the market. This would significantly increase the mining cost. A report by Iterative Capital also shows that the cost of production could rise considerably after the next halving.

Currently, the cost of producing a Bitcoin is approximately $6,000. With the halving and the assumption that as hash rate continues to grow, miners will upgrade their infrastructure and likely adopt a more optimal model, the cost will be close to $12,000.

Today Bitcoin’s market price remains overpriced and may expect soon a correction. Given the upcoming Bitcoin halving event and rise of regulated Bitcoin products offered by big-name institutional companies, it is highly likely for Bitcoin price to increase this year from the previous year high.

Recently Bloomberg senior commodity strategist – Mike McGlone, also said that Bitcoin price is set to increase this year. “Bitcoin is winning the adoption race, notably as a store-of-value in an environment that favors independent quasi-currencies,” said McGlone, adding: “In 2020, Bitcoin supply should increase about 2.5%, an all-time low on the way to zero growth.”