Bitcoin Whales Are Selling But The Rising Tide is Still Lifting Boats

The richest wallets in bitcoin are finally selling their stores, but bitcoin’s price keeps rising.

If you’re at all interested in bitcoin or have ventured outside the rock you may be living under – surely, you’ve heard tell of bitcoin whales. These mysterious, and often legendary, owners of some of the highest net-worth investors in the bitcoin market have long been painted as the boogeymen of cryptocurrencies. Rumored to control the entire health and quality of the market and bitcoin pricing with the power of their wallets alone.

In fact, throughout the years, many retail investors and crypto enthusiasts have attached a bitcoin value seismograph of sorts- ready to detect any rumblings that may come for their depths as an indication that a big dump, and a big crash, is coming our way. However recently- despite many whales emerging and depositing bitcoin into exchanges, the nascent investors, using exchange platforms like Bitvavo to help guide them in making sound investment choices- have yet to feel the aftershock of these movements.

Latest Surge Scrapes Glass Ceiling

Since early November, bitcoin has seen a string rally, one that has far surpassed the resistance levels set by many of the experts. After scraping just under $16k on the sixth, the infamous coin saw a slight pullback to around $14.5k closing on the seventh but has been steadily on the rise since. Suggesting that $15-16k may be the new correction point that the coin will be settling into.

While this near soaring price isn’t entirely unanticipated, some incidents that have had historically negative effects on bitcoin’s price have come to pass, neither of which have seemed to shake the confidence of investors- or market prices- much at all. In the past, each time large numbers of whale investors began moving bitcoin around and anytime there was litigious action which brought a showdown over the network- prices were seen to drop. However, despite the Fed’s once again seizing a hearty sum from silk road sales, a tumultuous election in the US that still has yet to properly shake out, the pandemic still raging, and whales starting to stir- bitcoin seems to have paid little notice.

Whales Are Selling and Prices Aren’t Dropping?

So how exactly do we know whales are selling? Well, as mentioned before, whales tend to hold a large chunk of the available bitcoin in the world, and it’s all scattered between a precious few crypto wallets. Most of which are considered “cold wallets” because they’re not actively connected to the internet. This is largely due to security risks posed from keeping your coins connected- like susceptibility to hacks or other types of cybersecurity risks.

So, when whales get the itch to move some bitcoin around or sell off bits of their massive stashes, they need to move them to “hot wallets”, or wallets that are online and generally connected to some sort of exchange. Seeing deposits drop into exchanges has historically signaled a massive retraction in bitcoin pricing across the board. To the point that when long sleeping whales began to emerge at the end of October, many bitcoin enthusiasts got a bit spooked. This is understandable if you look back on the influence that whales have long wielded over bitcoin specifically.

However, despite the short-lived scare-few investors felt pressure to sell, and as little as a 3% drop was seen before bitcoin soared to the heights it’s seeing at the time of writing the article.

Onchain Bitcoin stats:

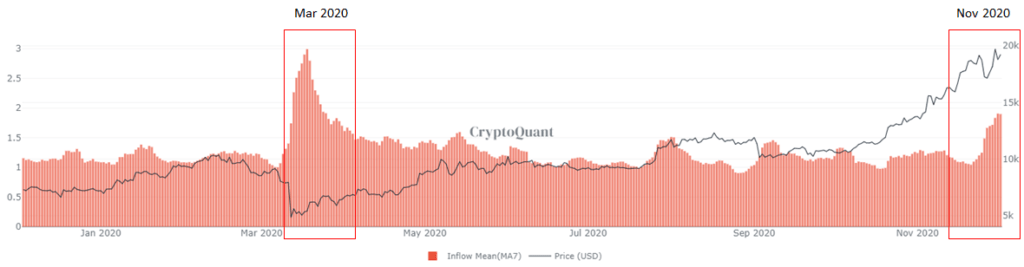

The 7d moving average of mean BTC inflow to all exchanges’ wallets shows an increase in Nov’ 2020. In the past few months, this value (MA7) never increased above 1.5.

An increase in MA7 value as seen in November ’20 trend indicates a larger value BTC inflow to the exchanges, meaning that whales are selling a significant amount of BTC in the past few days.

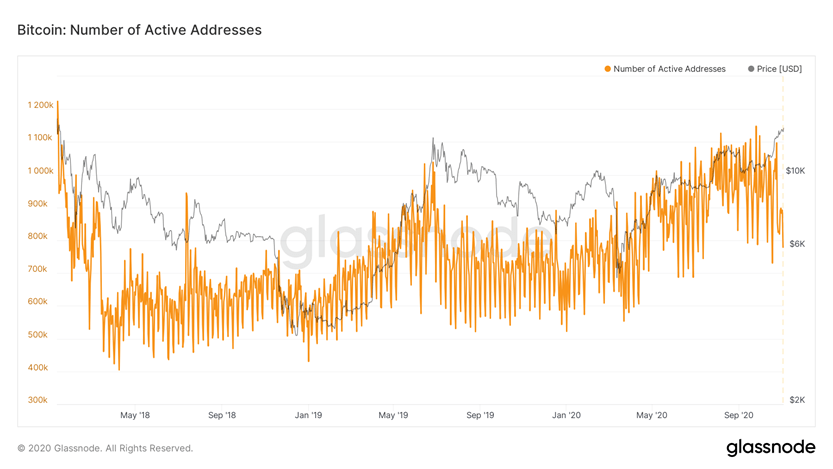

Another important on-chain indicator shows an increase in the network activity i.e. the number of active Bitcoin addresses is steadily increasing. This indicates either increase in BTC addresses (more believers) or investors are actively accumulating BTC and transferring to personal wallets (intent to hold Bitcoin).

Why We’re Still Seeing a Surge

Many believe that the reason bitcoin continues on its steady uphill climb this time isn’t because of the nefarious acts of mega-traders, but instead the current global political climate. As a massive devaluation of the Egyptian pound saw much racing toward cryptocurrencies for a much-needed hedge to existing assets, projections that the US dollar will decline has many Americans doing the same. As Britain enters into yet another lockdown, and much of Europe continues to feel the economic burn of the novel coronavirus, centralized banking systems worldwide are struggling to keep up with the lending practices required to help quantitative easing practices work.

Which could mean hyperinflation and fuel to the growing fire of distrust in fiat. While this doesn’t look great for the countries that have been slow to embrace healthy crypto practices and infrastructure, there is mounting evidence that bitcoin has become the hedge we’re all yearning for. Causing recent price surges to hold strong, even amidst such an uncertain future. For once, it’s not the whales that are controlling bitcoin valuations- but seemingly, retail investors.

Comments are closed.