BTC Price Valuation – Week 7

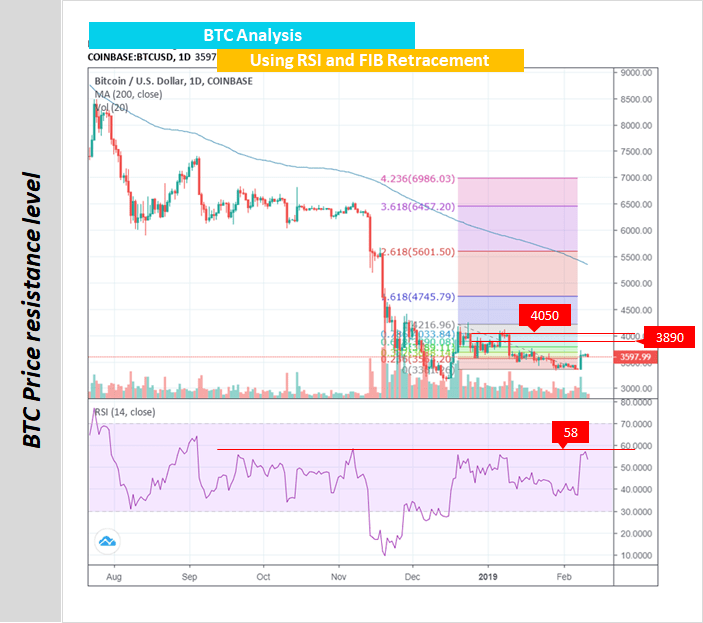

BTC Support level:

Last week on Friday, we saw an upward move in BTC price breaking the $3,500 resistance levels to give a new yearly high at $3,710. A break just above the 50% Fib retracement level from the previous wave low at $3,350.

At the moment, the $3,585 level is acting as strong support. If an upward momentum continues, the price could test the next resistance level at $3,890.

Historically based on the last 4 months trends, the BTC upward movement has been stopped and downward correction followed after reaching RSI level at 58. A situation, right now.

If a downside correction happens, the price could test the support level at $3,470 (calculation based on the previous 2 highs in 2019 and 200-hour moving average).

By looking at the current price movements, BTC is showing signs of a downside correction below $3,585. However, as long as the price is above the $3,500 support levels, bulls remain in action.

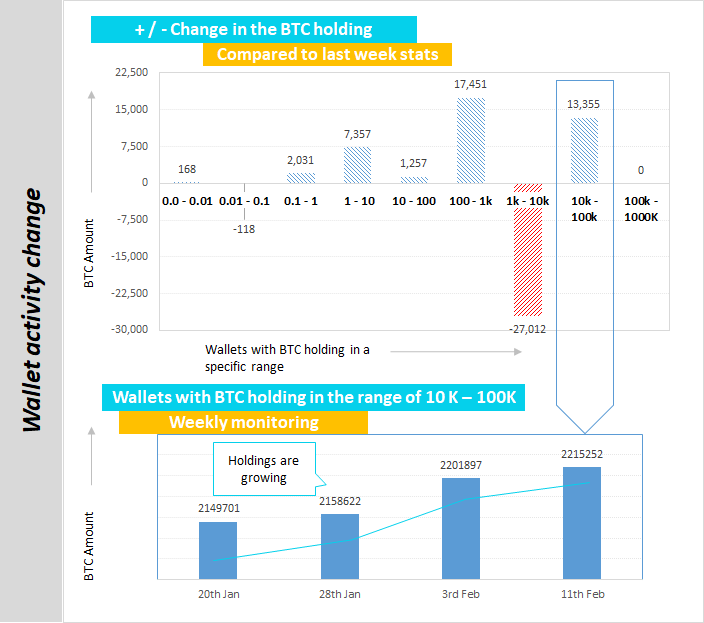

Interestingly, in the last 4 weeks wallets with BTC in the range 10 K – 100 K continue to increase. From 20th Jan to 11th Feb, 6 new wallets have joined the high ranks of whale group.

In total so far, this wallet (10K – 100K) group combined have added approx $225 Million equivalent of BTC.

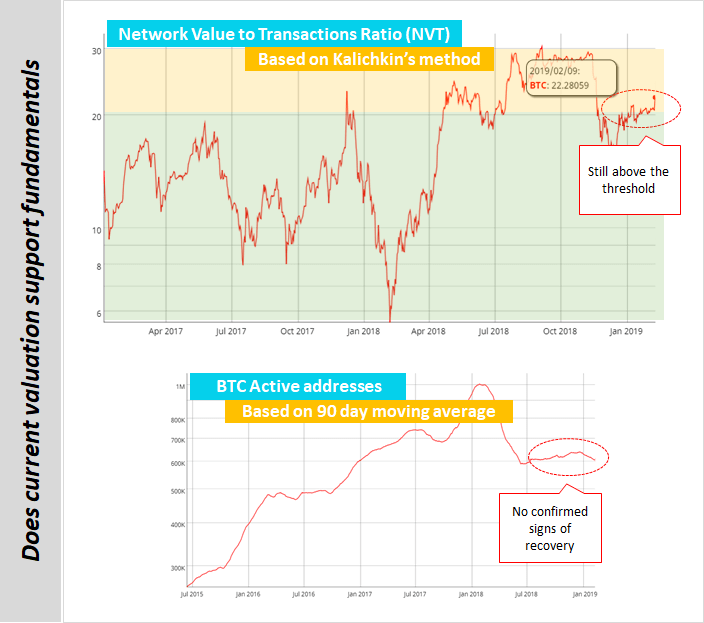

Does BTC value support fundamentals:

BTC active addresses stats is yet to show any confirmed signs of recovery. The continued downtrend in the active addresses suggests a lower Bitcoin network utility.

Based on NVT, the current valuation of Bitcoin is still in the alert zone, indicating current Bitcoin price (market cap) is not supported by the underlying utility of the Bitcoin network and therefore may have strong chances of price correction in near future.