Bitcoin near-term price trend: Factors that could tumble new ATH hopes in 2020

The cryptocurrency market is experiencing the return of bears. For over two weeks, Bitcoin is holding in extreme danger zones. With the largest cryptocurrency trading under crucial support levels, the traders are mostly cautious regarding the near-term price trend of Bitcoin, seemingly waiting for Bitcoin (BTC) to establish a clear support level or break past its record high.

Bitcoin price is hovering around $18,000 after a second rejection at around $19,500 – $19,800 level. In the near term, the following factors suggest a pull-down trend is more likely than a clean breach of the all-time-high Bitcoin price near $20,000.

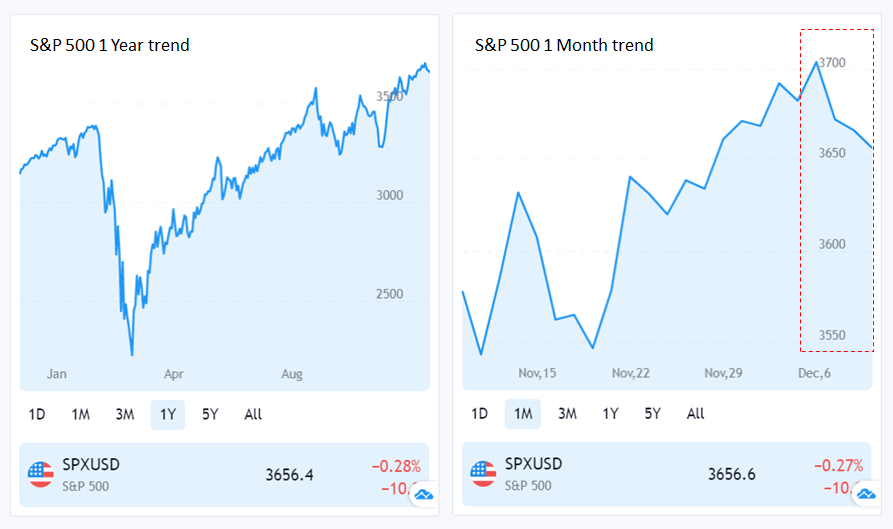

I) U.S. stocks have started to correct as worries surrounding the pandemic are mounting:

Since the stock market crash in March 2020, the S&P 500 had an impressive rally to record levels. Following a strong rally, the calls for a stock market correction are emerging. The recent pullback of the S&P 500 indicates investors are turning cautious.

The primary source of fear is uncertainty around the clearance of an additional monetary stimulus package. Despite the optimism around Covid-19 vaccines, the second wave of lockdowns and economic restrictions in both the U.S. and Europe is putting pressure on market sentiment.

II) Long-awaited Mt. Gox payout:

Mt. Gox, the infamous Japanese cryptocurrency exchange that went bankrupt in Feb 2014 after more than 850,000 BTC were supposedly lost to hackers, with 200,000 bitcoins recovered 2 weeks later. After years of legal battles, the Tokyo District Court ordered the appointed Trustee to prepare a rehabilitation effort to distribute about 150,000 BTC among the creditors.

Dec 15 is the latest deadline in the Mt. Gox rehabilitation process. By that date, the Trustee shall provide the rehabilitation plan to the court on the distribution of 150,000 Bitcoin from the trustee’s wallet to compensate users for losses. Even if the court approves the plan, the distribution won’t start immediately anyway. However, the fact that the distribution enters its final phase may become a strong bearish signal for the market.

Bottom line:

Short-term: Generally, technical analysts point toward the $19,500 to $19,600 range as the key resistance area in the foreseeable future. Above it, Bitcoin has the potential to break through a new all-time high and continue the rally. If Bitcoin breaks down below $17,500, traders expect anywhere between $13,000 to $16,000 as the support range.

Long-term: Nevertheless, traders should remember the Bitcoin (BTC) price is still in the middle of the bull run. In the last few months, we have seen an increased interest from institutional investors. A long-time Bitcoin (BTC) skeptic, Billionaire hedge fund manager Ray Dalio said that Bitcoin has a place in investment portfolios and could serve as a diversifier to gold.

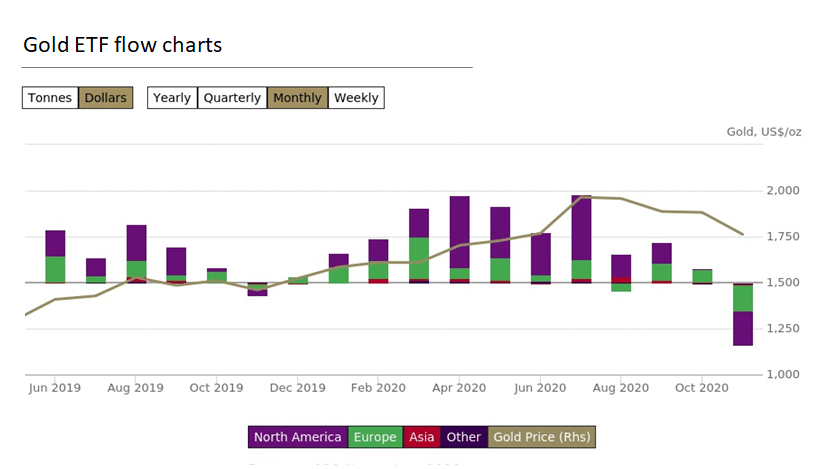

In Nov 2020, gold-backed ETFs and similar products (gold ETFs) recorded their first net outflows in twelve months and the second-largest monthly outflows ever. Gold ETF holdings decreased by 107 tonnes during the month – $6.8bn or 2.9% of assets under management – as the gold price had its worst monthly move (-6.3%, $1,763/ oz) since Nov 2016, when it dipped 7.4%.

Sources: Bloomberg, Company Filings, ICE Benchmark Administration, World Gold Council.

Recently JPMorgan strategists noted the rising trend in Bitcoin is hurting the gold market. The strategist pointed out the declining inflow of funds allocated to gold exchange-traded funds (ETFs) since October, as flows into Bitcoin (BTC) have swelled almost simultaneously.

Comments are closed.