Bakkt Bitcoin Volume In The First Week And Road Ahead

After a year of wait, Bakkt, the first to get regulatory approval for trading Bitcoin futures went live on September 23. Bakkt which many see as a gateway for Bitcoin widespread adoption, so far the volume shows little interest from institutional investors.

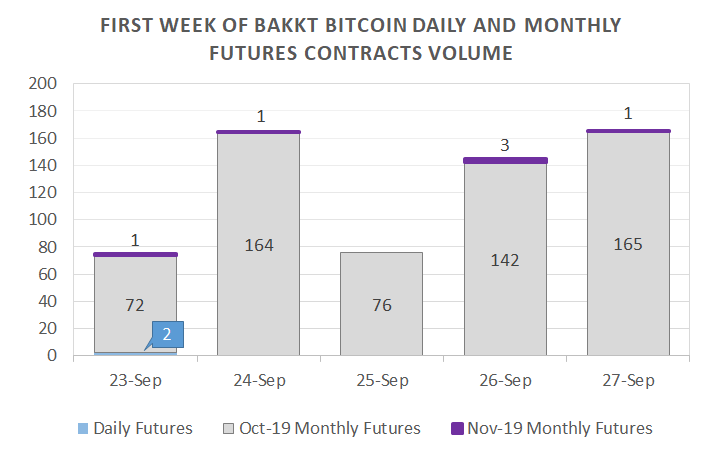

Bakkt Bitcoin futures contract volume in the first week:

As the first week has come to a close, the Bitcoin futures contract volume on the Bakkt platform remains unimpressive. In the first week total of ~627 BTC volume of Bakkt Bitcoin futures contracts were processed on the platform.

Surprisingly, the Bakkt platform managed only 2 BTC volume of Bitcoin daily futures contract trading in Week 1. The daily futures contract has been Bakkt’s vision from the beginning to create mass adoption of the crypto asset. However, due to extended delays to get regulatory approval, ICE later includes monthly futures contracts in their product offering.

Road ahead:

In the big picture, Bakkt’s regulated futures market is a historical development in Bitcoin history. There is no doubt in the platform’s ability to increase the public profile of Bitcoin as a trustworthy asset and gain institutional investors trust.

Most regulated futures contracts take time to build momentum as not all futures brokers are ready to clear them. Additionally, institutional investors have to consult their legal counsel, members, employ analysts, etc. So a few days of trading isn’t representative of the long term potential of the platform.

Bakkt’s larger ecosystem will also include merchant and consumer applications. Its first use cases will be for trading and conversion of Bitcoin versus fiat currencies.

Starbucks, a founding partner in Bakkt will most likely allow U.S. customers to pay for its products using Bakkt’s application. The daily futures contract settlement could allow participants (merchants) to conveniently hedge against the risk of Bitcoin price volatility.