Rating System To Score Cryptocurrency Likelihood to be a Security

Leading crypto-financial firms have developed a system to score which cryptocurrency assets are more or less likely to be a security. Its council members include Coinbase, Kraken, Circle, Bittrex, etc. The score will guide crypto-financial firms like exchanges or investment management firms to determine if to provide services for the cryptocurrency asset in question.

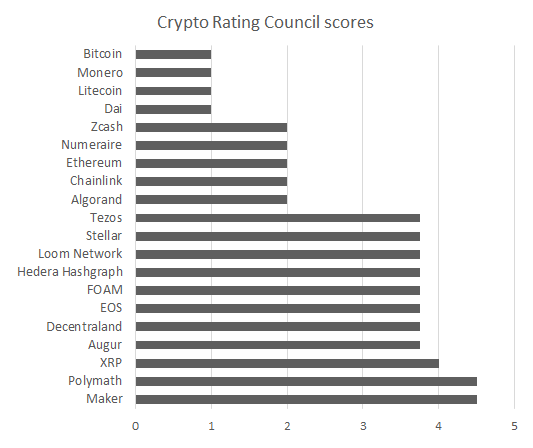

The system (Crypto Rating Council) is available for public view starting today. The likelihood of a cryptocurrency asset to be security is rated on a 1 to 5 score. A score of 1 means that the underlying cryptocurrency has few or no characteristics of a security. 5 means that an asset has many characteristics strongly consistent with treatment as security.

Coinbase Chief Legal Officer, Brian Brooks said that “Like the Motion Picture Association’s system for rating movies, this new system will provide clarity and a common language for assessing important aspects of individual crypto assets—in this case, securities law compliance”.

List of cryptocurrencies currently rated by the Crypto Rating Council

Rating system to score cryptocurrency likelihood to be a security. 5 indicates high probability, 1 indicates least likely

Interestingly the council has rated Ripple ‘XRP’ as 4 suggesting the asset could be a security. The key reasons mentioned were due to its –

- Usage of investment like language,

- Marketing of token suggesting an opportunity to earn a profit and

- Sale of tokens or token interests prior to the existence of token utility.

Recently, a group of XRP investors filed a lawsuit against Ripple arguing that XRP tokens are unregistered securities.

Today’s regulatory complexity and uncertainty create a challenging environment for emerging U.S. blockchain technologies and investors. The cases of Kik and ICOBox are few recent examples of blockchain startups clashing with SEC over classifying their digital asset as unregulated securities.

The council hopes the rating would give entrepreneurs and investors the understanding of the regulatory regime of the underlying cryptocurrency.