Argentina imposes more restrictions on USD purchases. What’s in it for Bitcoin

The central bank of Argentina has imposed further restrictions for citizens to buy the U.S. dollar. Earlier individuals had a limit to buy $10,000 per month. The fear of Argentina Peso nearing to the edge of hyperinflation, citizens have been hedging Peso with a stable foreign currency, mostly U.S. Dollar. With new restrictions, now citizens are limited to buy only $200 per month.

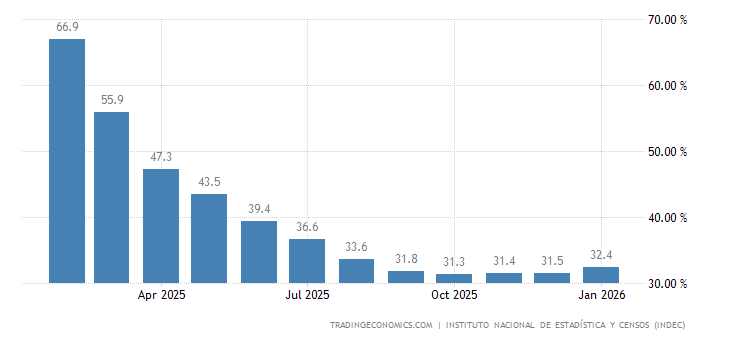

As per the central bank poll at the beginning of this year, the economist predicted inflation to drop to 31.9 percent in 2019. However, the inflation rate kept elevating in 2019 reaching 53.5% in Sept 2019.

Central banks hope new limits will help to maintain exchange stability and protect reserves against the degree of uncertainty. The restrictions are further for individuals with cash purchases limiting buy capacity to $100.

What’s in it for Bitcoin:

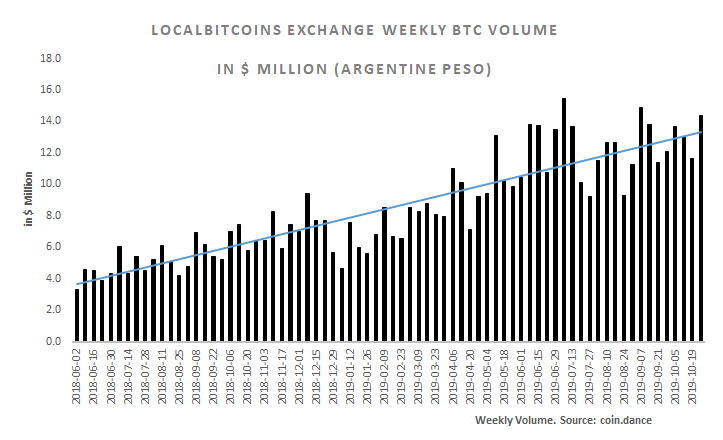

The fear of hyperinflation and continued central bank restrictions, Citizens have turned to cryptocurrencies for remittance purposes and hedge against the deterioration of local fiat currencies. The volumes in local exchanges (and LocalBitcoins exchange) have been sharply increasing since the beginning of 2019.

Many exchanges are planning to launch their operations in Argentina. Recently Binance hinted at launching a fiat-to-crypto platform in the country. Also, Huobi is soon introducing a fiat gateway in Huobi Argentina exchange.

In Sept 2019, Bitpay announced the firm partnership with Mercado Livre, one of the largest eCommerce providers in Latin America allowing users to buy and use a cryptocurrency like Bitcoin and Bitcoin Cash to pay for utilities, metro rides, and Uber credits.

Comments are closed.