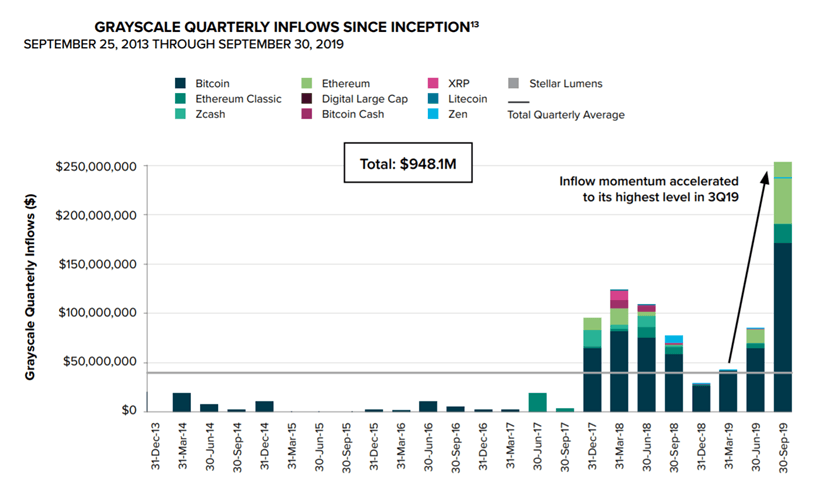

Grayscale records largest inflow in Q3 2019, 3X more than Q2 2019

Grayscale Investments, a digital currency asset manager released on Tuesday its Grayscale Digital Asset Investment Report. The report highlights strong performance across its products in Q3 2019.

In Q3 2019, Grayscale across its product range saw strongest demand since its inception raising a total of approx $255 million. The demand in Q3 is three times more than the inflow in the second quarter of 2019. The majority of this investment (nearly 84%) came from institutional investors, dominated by hedge funds.

The $255 million inflows in Q3 2019 brings year-to-date inflows to $382 million. In the firm’s 6-year history, Bitcoin trust saw largest inflow (i.e. approx $278 million) in 2019.

Demand for non-Bitcoin products also continues to grow. The inflow for non-Bitcoin products reached $104 million in 2019, led by Ethereum Trust ($77 million) and Ethereum Classic Trust ($25 million).

Grayscale hopes to continue the momentum

Recently, Grayscale Investments got a green light from FINRA for its Digital Large Cap Fund (DLC) product for public quotation. It was earlier offered as a private placement to accredited investors only.

Now with FINRA approval, GDLCF can be publicly-quoted in the OTC market. It will give investors exposure to crypto price movements through a diversified basket of large-cap digital currencies.

Comments are closed.