DeFi Yield Farming – Simplified for broader use

Yield farming, a new uprising trend in cryptocurrency allows people to earn interest by parking their crypto capital in a DeFi product. According to DefiPulse, the total value locked in DeFi smart contracts is upward of $7.0 Billion as of this writing, a 15 times jump compared to year-ago stats.

So, why is it gaining so much attention?

Unlike traditional savings accounts, yield farming rewards you with a higher interest rate. The national average APY on savings accounts is just 0.06%, according to the Federal Deposit Insurance Corporation (FDIC). That’s over 100-150 times less than what the crypto yield farming strategies offer. Some yield farmers claim to have earned upward of 1000% returns from DeFi products.

How Yield farmers earn

Yield farmers earn profit by providing liquidity to the protocols, in simple words providing a supply of cryptocurrencies(tokens) in respective platforms like compound, curve, etc. Platforms incentivize these suppliers by rewarding them in different ways:

(1) Sharing trading fee: Decentralized exchanges offer liquidity providers (LPs) with fees as a reward for adding their crypto assets to a pool. Liquidity pools are configured between two assets. Each time someone trades, LPs that contributed to the pool earns a fee.

(2) Incentives: Other than sharing trading fees, few projects also offer liquidity providers extra incentives (or handouts of protocols own token) to maintain healthy volume in the DEX.

(3) Earn interest from lending: Lending capital is the easiest way to earn a return in DeFi. In this setup, lenders add their stable coins (DAI, USDC, etc) to the pool. A user in need of a loan, deposit their assets (BTC or ETH as collateral) with more value than their loan. As long as the collateral ratio (value of collateral/value of the loan) is maintained above the liquidation minimum, borrowers have time to repay loans with interest to the Liquidity Pool and withdraw their collateral. In case the collateral ratio falls below a certain threshold, the collateral is liquidated and repaid to lenders. This setup ensures that lenders don’t lose money when borrowers default.

Though interest rates in DeFi are so much juicier, it is not for everyone.

A survey in July 2020 conducted by ARPA found that despite the hype, DeFi remains a niche corner of the cryptocurrency market and puts DeFi users at around 1%. The likely reasons for drawing lesser users are – complexity, rising competition, and risk which limits average users to participate and take advantage of this new financial product.

(1) Too many DeFi products to select from.

Given the rise of competing DeFi products, it is a full-time job to monitor these strategies and tap on the right one on-time to be profitable. It requires spending hours and hours of research and tracking various strategies. For both experienced and inexperienced investors, it’s a lot to take in.

It’s also important to note that yield farming is only profitable if you’re willing to put a significant sum of money to work. Yield farming with $100-1,000 in crypto will result in a net loss. Why? Skyrocketing ETH gas cost off-set profits, making DeFi strategy execution more expensive for investors putting small amounts.

(2) Becoming a yield farmer is not risk-free.

“I think one big one is just that a lot of people are underestimating smart contract risk.”

Ethereum co-founder Vitalik Buterin has warned of the dangers of ‘smart contract risk’ in DeFi protocols.

You’ll have to match your risk tolerance before deciding to become a liquidity provider. There have been a number of high profile smart contract exploits in DeFi this year with examples including the bZx flash loan exploit in February that resulted in the loss of almost $1 million worth of crypto, and the Bancor smart contract bug in June that caused a network shutdown.

Additionally earning returns by adding liquidity does not necessarily mean the best returns on your assets. It could also turn to impermanent loss, which is the loss created by providing liquidity for an asset that rapidly appreciates.

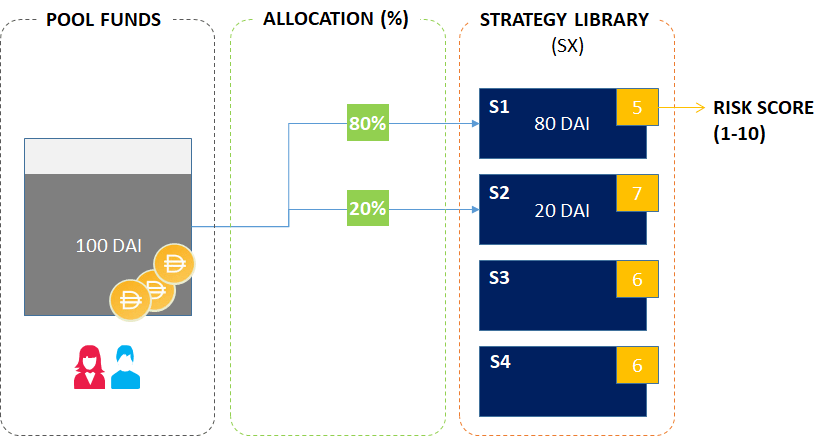

A smart investor can reduce the risk exposures in the pool by spreading its allocation across multiple products (or pools) instead of just relying solely on one and move assets from pool to pool to tap on the best available strategies. However, such a strategy will result in increased gas fees as previously highlighted in this article.

DeFi platform that creates wider usability for all investor kind.

APY.Finance is one such team that recognized these challenges and is working towards bringing a platform that simplifies yield farming in one single click and helps to maximize yield farmers returns.

APY.Finance achieves this as follows:

(1) Instead of multiple transactions and incur $100 gas fees, all users deposit are collected in a pool. As the value in the pool gets accumulated, the APY platform routes the entire fund in a single transaction to the respective strategy. This way users save gas fees in excess of 99% making yield farming accessible for all investor kinds (big or small).

(2) The transactions are routed automatically to the best available strategies in a given time. The selection of strategy is not only decided based on the highest APY paying pool but also adjusted for risk. For each strategy, a risk score is computed, and accordingly, funds are allocated to strategies minimizing the risk exposure for users.

Closing remarks

In a survey performed by ARPA in Jul ’20 for DeFi usage, unattractive interest rates, smart contract vulnerability, and poor user experience were the top reasons people did not use decentralized finance protocols. Beyond this, many respondents also cited a high ETH gas fee that can lead to losses for users.

The innovations developed by APY.Finance (as explained above) could help to increase users’ APY on crypto capital and make DeFi products attractive and easily accessible to wider users.

To know more about APY. Finance, recommend reading their Medium post.

Comments are closed.