Decentralized exchanges (DEX) in 2020 gaining ground

Investing in crypto assets has certainly evolved throughout 2020 and will continue to expand in the coming years. Today’s trading landscape is primarily dominated by a few large players, predominantly Coinbase, Kraken, Gemini, Bitstamp, Bitfinex, and Binance.

While centralized trading has been widely popular, it’s not quite the new financial economy most crypto enthusiasts and entrepreneurs are hoping to achieve. One of the most important and subsequently hardest aspects to creating a new financial system is generating the necessary liquidity required for efficient investing.

Liquidity in the decentralized-exchanges (DEX)

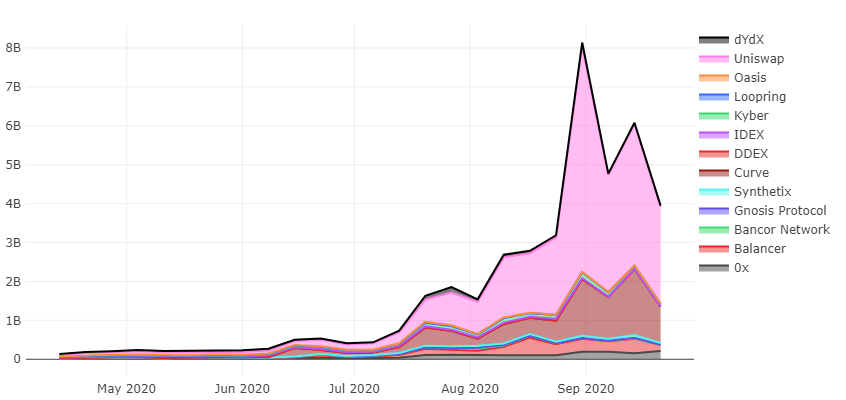

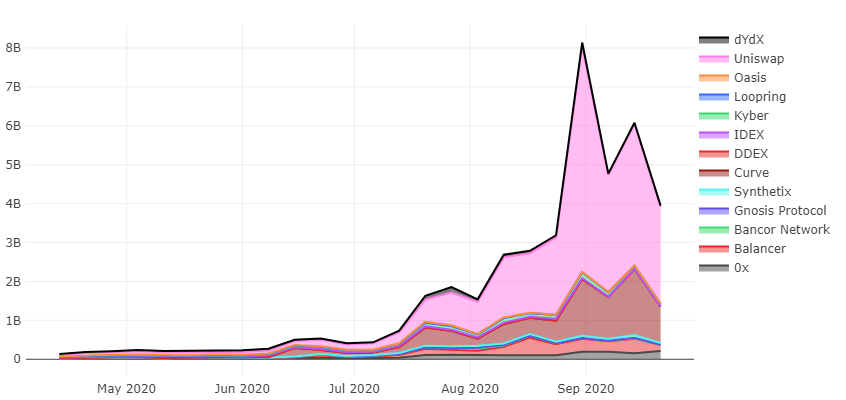

Liquidity is the capacity for an investor to convert any asset into cash quickly. The term also refers to an individual’s ability to buy or sell a financial instrument without affecting the asset’s price. This was obviously incredibly difficult for DEXs in 2019 when the volume across all platforms was collectively just $2 Billion.

Now in 2020, DEXs are gaining ground. The monthly volume in DEXs has increased to $10-15 billion. The key contributors – UniSwap and Curve have seen their daily volume surpass Coinbase and several other centralized exchanges. The main driver for this rise is the popularity of yield farming.

Solving liquidity challenge

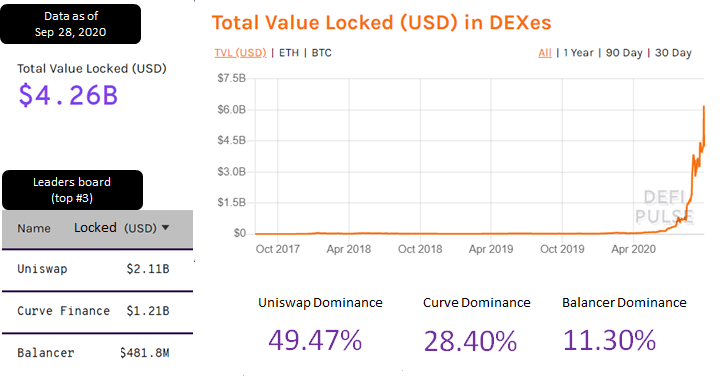

Both UniSwap and Curve mitigate the challenge of liquidity by introducing liquidity pools in their exchange. Just like centralized-crypto exchanges who use the services of experienced market makers to ensure healthy volume levels, DEX through its lucrative incentive model allows any person to act as a liquidity provider.

Given the transparent, permissionless, and trustless nature of these protocols, it gained a lot of attention from both market makers and crypto traders alike. Any user can add liquidity to a pool for a given trade-pair and in return receive a portion of trading fees from the trades that settled in the pool. To make sure that the assets in the pool are always available on-demand, the platform algorithm automatically adjusts the pool’s economic incentive. This adjustment triggers pool participants to accordingly add or remove assets, maintaining supply-demand equilibrium in the DEX.

Mirroring traditional market makers’ business model in the DEX has been incredibly successful. On any given day the collective value locked in these pools exceeds well over $4.0 billion. UniSwap has the largest share, leading with $2.1 billion, followed by Curve finance with over $1.2 billion crypto assets locked in these pools.

Is this model sustainable?

It depends on how the platform is able to keep itself up-to-date with the users (community) latest interest and adapts to the strategies proactively as the marketplace evolves, ensuring the platform continued usage.

To do so many DEX have now introduced their governance token, giving its community an increasing amount of power to make the protocol decisions. Governance tokens in a platform serve as a capital that offers some control over the distribution of economic resources. In other words, whoever has this capital, has the power to decide which inputs to use to create things or useful work or provide services.

Once this power is distributed in the community, it’s up to the community how they participate – speculate or co-create the platform with DEX developers as the marketplace evolves.

Comments are closed.