Where Bitcoin Fits? Is It A Digital Gold?

In the centralized traditional banking system, transferring money is time-consuming, requires intermediaries which takes a service fee and subject to heavy regulation for the prevention of fraud. Bitcoin removes middlemen while increasing security and many hope one day Bitcoin fits in our existing financial system.

It can process transactions in minutes, however, the volatile value of Bitcoin and anonymous nature where user identity is not tied to address, making it difficult to trace from where funds originated are some of the red flags for banks. Therefore, Bitcoin will have a hard fit in merging with the traditional banking system.

Today, some banks are working on the idea of launching their own stable digital currency. These bank-issued digital currencies will still be controlled from their own system. It is yet to be seen how it may work in congestion with the traditional banking system. First of its kind, is expected to be soon tested in Japan by Q1 end.

So where Bitcoin fits then? Possible scenarios of Bitcoin adoption:

Scenario 1: Many may suggest Bitcoin is Digital Gold but is it not too early to give the same treatment as gold to BTC.

Today, all the gold that has ever been mined is currently worth 200 times more than the total value of Bitcoin by market capitalization. It has a history of thousands years.

Bitcoin in comparison still in its early stage of global adoption and development, does it belong to the asset class of precious metals and share similar characteristics?.

Typically when assets like stocks or bonds are in free fall, investors flee their money into safe heaven like ‘gold’.

<< Chart A shows comparison of Q4 2018 price movement in Stocks, Gold and BTC.

In Q4 2018, when global stock markets experienced their worst quarter since 2009, Bitcoin had an opportunity to demonstrate safe haven qualities similar to likes of precious metal ‘gold’.

However, the Bitcoin price dropped further, while gold rallied. Bitcoin’s price plunge along with the stock market in Q4 2018 proves Bitcoin is more like a stock than digital gold. Bitcoin is just 10 years old and it is too early to debate if Bitcoin is like gold.

Just because Bitcoin didn’t track gold’s price movement for one quarter, does not mean it will repeat this pattern.

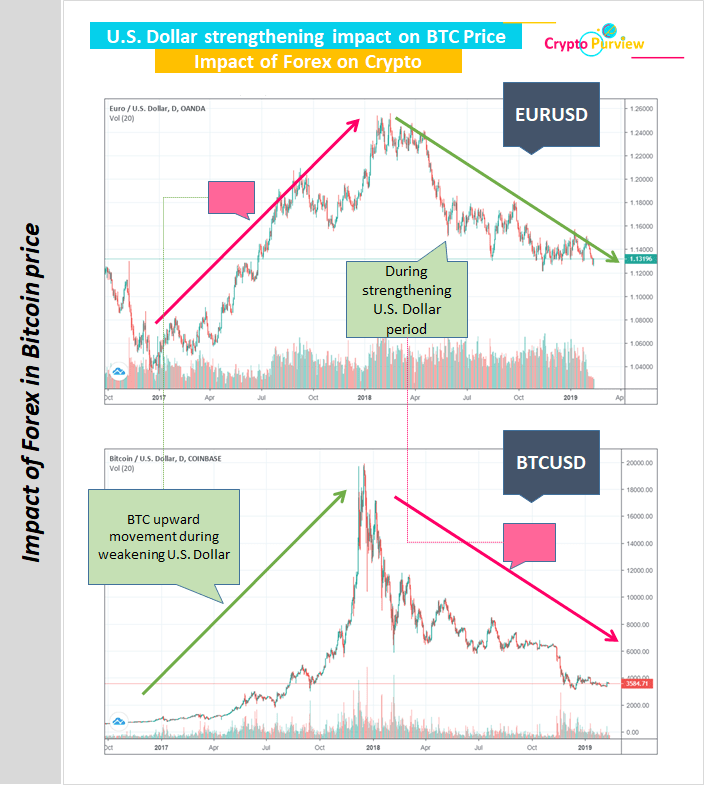

Scenario 2: Currently, foreign reserves are used as a hedge against countries own economy. Usually, countries whose economies are heavily dependent on export products may use foreign currency as a buffer, should the exports or value of their currency drop.

Today most countries hold U.S. dollar as a foreign reserve. Given the worries of increasing Global debt, it may weaken the fiat value of a county with huge debt. Countries may opt to liquidate weaker foreign reserves and look for a safer alternative. Worldwide governments opinion in-general is negative towards cryptocurrency but it may change to neutral.

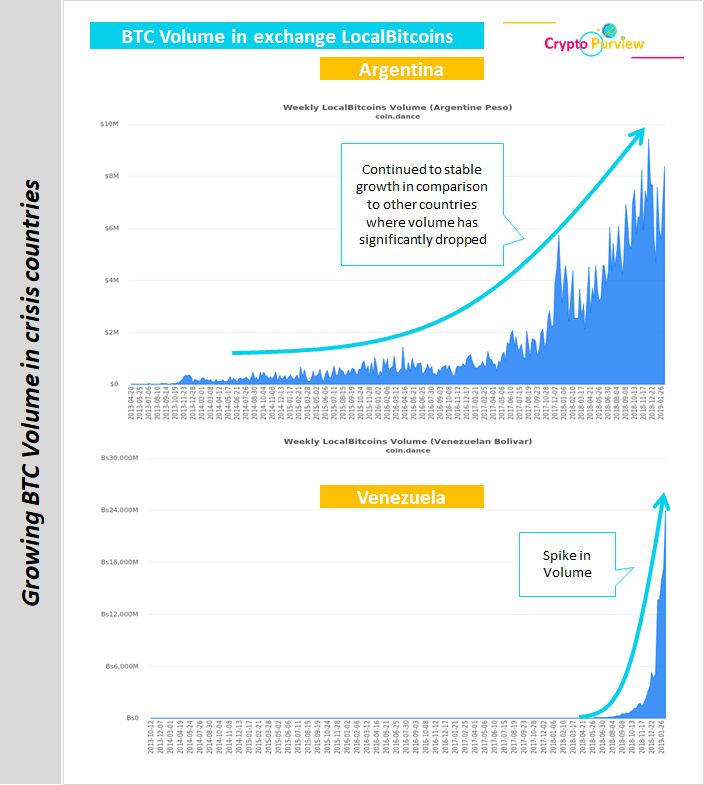

Scenario 3: Places of Economy worries / high-inflation. Countries like Venezuela, Argentina and sanction heavy countries like Iran are looking for alternative assets like cryptocurrency to shelter from economic turbulence.

Scenario 4: Banks continuously lookout for providing alternate investment class to their customers. Given if the Bitcoin demand increases in the following months, Bank will rush to add this lucrative investment asset option to meet customer demands.

Scenario 5: Cross region quick and cheap transfer of funds. For big cross-region fund transfer, it may take days to process the transaction. Bitcoin in comparison takes a few minutes with low fee. A popular case you might recall last year when

Scenario 6: Growing interest from merchants who need payments in real-time. Usually, payments from Visa or Master card are processed and sent to merchants within 3 business days (Read more here). The process somehow requires some manual work at the merchant’s side to verify accuracy. In some rare cases, payments are made via cheque which may take up to a week long of processing. Therefore these delays weigh in the decision to accept Bitcoin or cryptocurrency.