TransferGo to use Ripple’s On-Demand Liquidity (ODL) platform

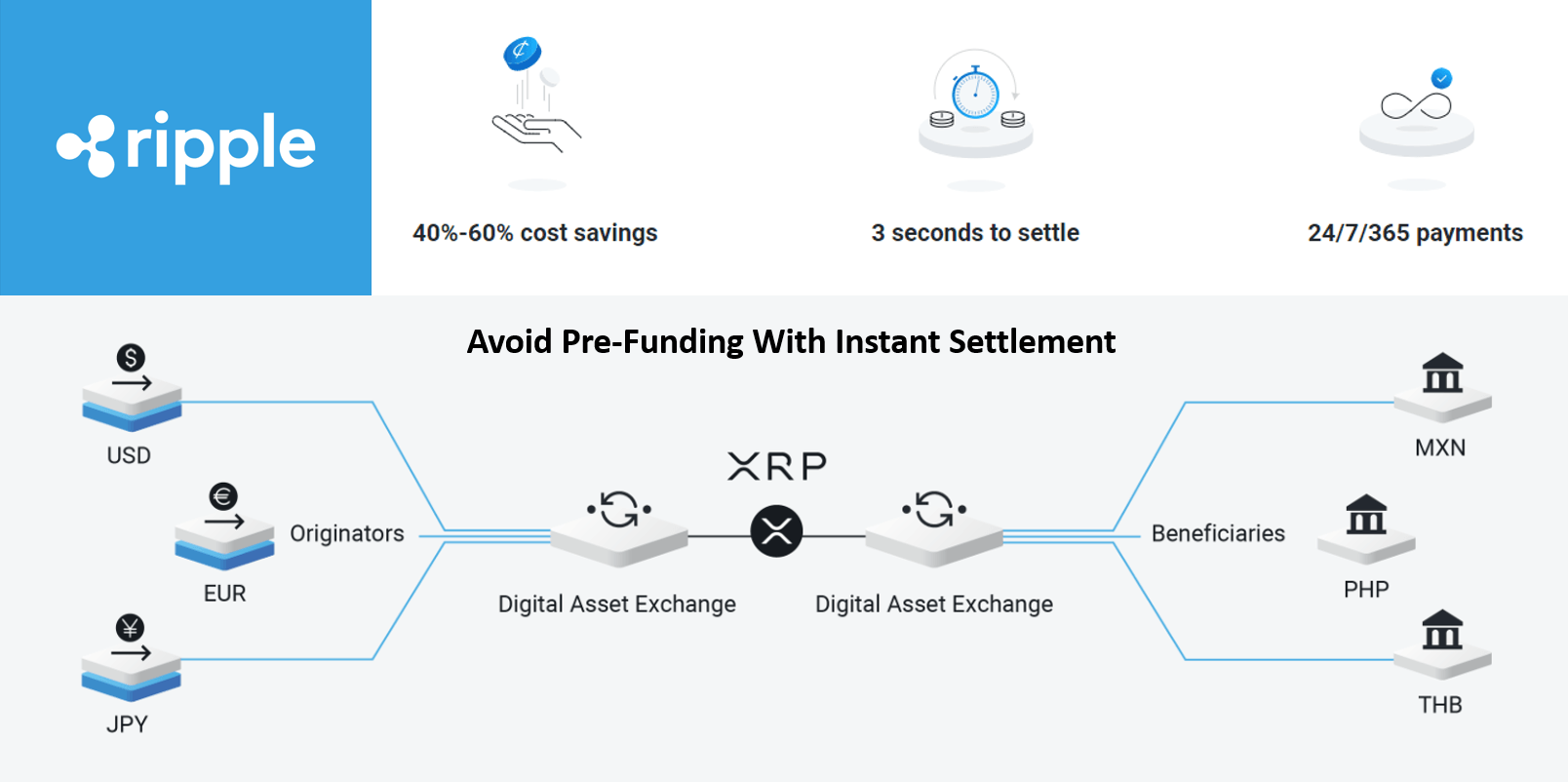

TransferGo, a digital remittance solution for migrant workers is looking to move to Ripple’s On-Demand Liquidity (ODL) payment platform. Ripple’s On-Demand Liquidity (ODL) platform leverages XRP cryptocurrency as a bridge for cross border payments.

In 2018 TransferGo partnered with Ripple to help Indian migrant workers send money from Europe to their homes and families in India. Using Ripple’s xCurrent, TransferGo was able to pay out remittances in a few minutes. TransferGo now plans to leverage on Ripple’s ODL platform to further narrow down the remittance time.

Even a few minutes will be too slow: TransferGo’s Co-Founder and CEO Daumantas Dvilinskas acknowledges that by 2020, even a few minutes will be too slow, which is why TransferGo is looking to use RippleNet’s On-Demand Liquidity with XRP as an alternative to pre-funding.

Solving the biggest challenge:

TransferGo’s biggest challenge was the time and expense of constantly integrating with new banking partners every time it opened new settlement corridors.

Earlier to open new settlement corridors, TransferGo used more like the traditional way of building the infrastructure, requiring to link Transfergo infrastructure to those of banking partners. However, every integration was bespoke, which took up a lot of tech resources and was time-consuming.

With RippleNet’s integrated network of global banks and financial institutions, firms like TransferGo don’t have to redo it each time, reducing integration costs. Now TransferGo is able to help its customers save up to 90% on traditional fees for cross-border transfers.

TransferGo is also planning to expand its real-time operations into new markets in Southeast Asia, Latin America and Africa with RippleNet.

About TransferGo:

TransferGo currently supports 22 currencies across 47 countries. Regulated by the UK Financial Conduct Authority (FCA), TransferGo in 2017 processed over £500 million in online transfers via the web and app.

Looking ahead:

Recently Ripple unified the features of all previous products into one system called RippleNet. Under it, xVia and XCurrent coexist as one system and ODL previously known as xRapid is used as additional service meant to increase XRP adoption.

RippleNet already has a customer base of more than 300 banks and financial institutions. Now with Ripple’s On-Demand Liquidity platform, customers can settle cross-border transactions in just a few seconds with no need for pre-funding. Catalyst Corporate Credit Union, MercuryFX, Cuallix, MoneyGram and now TransferGo have publicly announced their moves to Ripple’s ODL platform.

Earlier this month MoneyGram announced processing 10% of its U.S-Mexico transaction volume through Ripple’s On-Demand Liquidity (ODL) platform and plans to expand Ripple’s ODL usage in four more corridors by the end of this year.