Motives Of Facebook In Launching Digital Coin

Digital wallets are scaling quickly than traditional banks. It is believed that digital wallets could upend traditional banks within 5 to 7 years. Traditional banks reliance on physical infrastructure which builds customer acquisition costs to $350-$1,500 per person. In comparison, digital wallets can acquire customers at just $20 per person, becoming effective channels for banks to engage and retain customers.

China points the way to digital wallets and mobile payments. As Seen in China, digital wallets offer value beyond financial services. Mobile payments aren’t something new, they’re now the norm.

Their ease of use and accessibility have caused mobile payments to soar 12-fold to $24 trillion in 2018. Last year, China’s two biggest tech giants, Tencent(Wechat Pay) and Alibaba, each handled more payments per month than PayPal’s $451 billion for 2017.

Facebook seizing the opportunity – “app for everything”

If the value of a digital wallet customer were that of a bank customer, digital wallet providers could be worth approximately $700 billion in 2023. [inlinetweet]It is estimated that mobile value transfers could reach $55 Trillion by 2022.[/inlinetweet]

Digital wallets are an important step in the evolution of mobile value transfers, making transactions and exchanges simple and seamless in a user’s everyday life. Facebook is replicating the business model of WeChat and hope to set itself in the path to developing a financial service worldwide.

[inlinetweet]Facebook’s much-hyped project Libra, may launch in India within a matter of months[/inlinetweet], according to a Bloomberg report. The project, led by a team of PayPal alumni, is expected to launch a stable coin which will be integrated with WhatsApp’s platform currently used as a messaging app by over 200-250 million users in India.Once launched, in addition to using WhatsApp as a messaging app, users can also manage financial services like card repayments, peer-to-peer transfers, utility payments, or use to book travel, taxi, shopping, etc from the app.

But it is not as easy as it seems

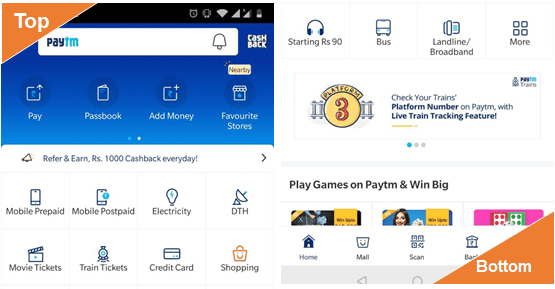

(1) Facebook may face stiff competition with India’s most used payment app PayTM. PayTM is India’s number 1 wallet & payment app with over 300 million users used for utility bill payments to booking travel, or movie tickets, order food, shopping, bank transfer & much more.

(2) After Cambridge Analytica Scandal, Facebook has been at the center of public and regulatory scrutiny over the misuse of consumers’ personal data.

Why anyone would trust them now with their money. Many have lost trust and this is also apparent in their declining job acceptance rate. As reported by CNBC, multiple former recruiters say candidates are turning down job offers from what was once considered the best place to work in the United States.

Why Facebook is using blockchain technology

By leveraging blockchain technology, Facebook plans to build a payment transaction network where there is no involvement of trusted-third-party (like Visa or Mastercard). It also makes Facebook’s digital wallet more secure than its competitor’s wallet.

As reported by Reuters, Facebook has set up a new financial technology company called ‘Libra Networks’ in Switzerland which will focus on developing related software (using blockchain technology) for financing services like payments, identity management as well as big data analysis.

Earlier this year in Feb 2019, Facebook acquired blockchain firm ‘Chainspace’, which works on research and development of smart contracts.

Once launched, do expect a series of big enterprises/retailers partnering with Facebook and accepting the Facebook stable coin in their stores. Partners (or retailers) may also provide a discount to customers for paying with Facebook stable coin.