Is Bitcoin Sitting On The Bomb

Altcoins have started to record large gains against Bitcoin. Strong momentum of altcoins like Enjin, Raden Network has prevented Bitcoin bulls from surrendering to bears and maintained price action above $3700 support levels.

While Bitcoin has avoided a near-term drop to $3,500, it also was unable to break out from the $4,200 resistance level. Historically Bitcoin has a tendency to record large sell-offs following weeks or months of low volatility. The extended period of stability in the range $3700 – $3900 has worried investors.

Network utility:

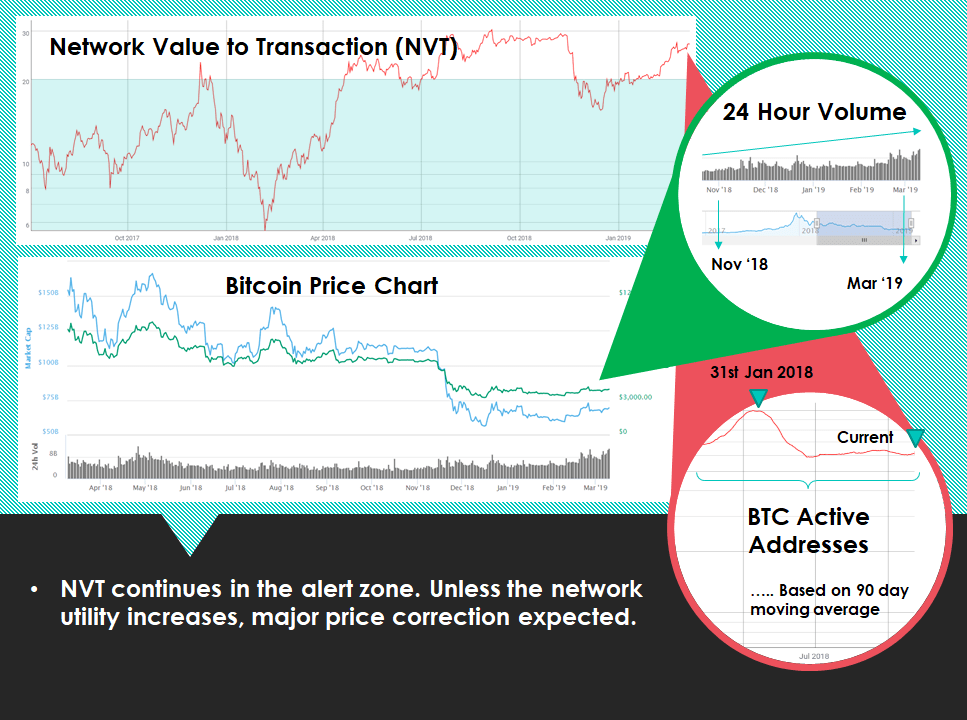

Though transaction volume in exchanges has recovered, the network utility (NVT) is yet to show any sign of improvement. Generally speaking, a healthy network utility can be correlated as positive sentiment or confidence over an asset. During the previous bull run (2015-2017), NVT was well maintained within the safe-zone (NVT value under 20).

A “high” network to transaction value denotes an asset is overvalued per unit of on-chain transaction volume. As we see today, NVT is approaching near the alert zone, a level similar to Nov 2018 which triggered massive sell-off.

Support And Confidence:

Looking at the BTC wallets, compared to last month, most of the small or mid-size investors (holding between 0-100 BTC) have increased their holding. The recent rally in BTC price could be credited to the latest developments in the blockchain industry, like,

- Big institution and enterprise support for cryptocurrencies – Samsung Crypto wallet, Fidelity’s new institutional cryptocurrency products.

- Lightning Network implementation, the second layer in Bitcoin Network allowing micropayments which got appreciation by Twitter CEO.

- Growth in dApp users in EOS and Tron platform.

On the other hand, reports of Facebook building their own stable cryptocurrency blockchain and JP Morgan launch of J-Coin stable currency have also raised questions what is then the use of existing cryptocurrencies. Rather partnering with established blockchain projects, why enterprises are building their own.

For sure these recent developments have given rise to investors confidence but did it exchanged hands from a patient holder to impatient?. Unlike whales who have thick skin for price volatility, a 10% drop matters a lot for small investors. If the price drops further from $3700, it may trigger massive sell-off and retest $3000 levels.

Bitcoin Sitting On The Bomb. How To Defuse It:

Given the above perspective, We may not be far away from yet another bear attack. Unless there is a significant increase in network utility, there are strong chances of price correction.

Arguably of the total ~50 Million crypto holders, hardly 500-750K may have used blockchain-based dApps and very few used it for payment. The utility cannot be created if crypto enthusiastic are only here for speculation. It’s up to us how we strengthen Bitcoin & Blockchain.

“Opt for merchants who accept cryptocurrencies or Try one dApp”

Where bitcoin is accepted?

- List of Merchants accepting Bitcoin payments:

- Use CoinMap to find the merchant near your place. It has listed 14,400+ merchants worldwide.

- Some well-known companies who accept Bitcoin as payment: Microsoft, Expedia, Tesla, Shopify, Subway, Overstock, etc.

- List of dApps which you could start using [Complete list of dApps]:

- Brave Browser – An android internet browser which provides an option to block ads or option to earn by engaging with a browser provided ads.

- Try Games like Epic Dragon or EOS Knights.

- Social networking and blogging sites like Steemit, Karma.