Cryptocurrency ‘JPM Coin’ launched by JP Morgan – For what purpose?

After Mizuho Financial Group of Japan, now JP Morgan launches its own Cryptocurrency ‘JPM Coin’.

“We have always believed in the potential of blockchain technology and we are supportive of cryptocurrencies as long as they are properly controlled and regulated.”

– Umar Farooq, JP Morgan’s head of Digital Treasury Services and Blockchain, wrote in an online Q&A page

The JPM Coin is based on blockchain-based technology enabling the instantaneous transfer of payments between institutional accounts. A digital coin representing United States Dollar held in designated accounts at JPMorgan Chase N.A.

Currently, JPM Coin will be piloted with a small number of J.P. Morgan’s institutional clients and have no plans to make this available to individuals at this stage.

How to use JPM:

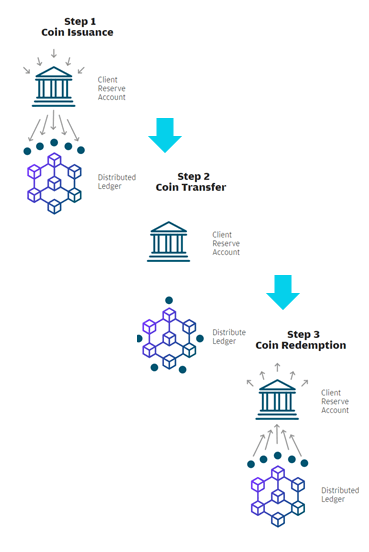

To use, J.P. Morgan clients have to deposit money to a designated account to receive an equivalent number of JPM Coins.

These JPM Coins can then be used by these clients for transactions over the bank’s blockchain network with other J.P. Morgan institutional clients (e.g., money movement, payments in securities transactions).

At any time, holders of JPM Coins can redeem them for US Dollar from the JP Morgan.

As per JP Morgan Q&A page, Over time, JPM Coin will be extended to other major currencies besides US Dollar.

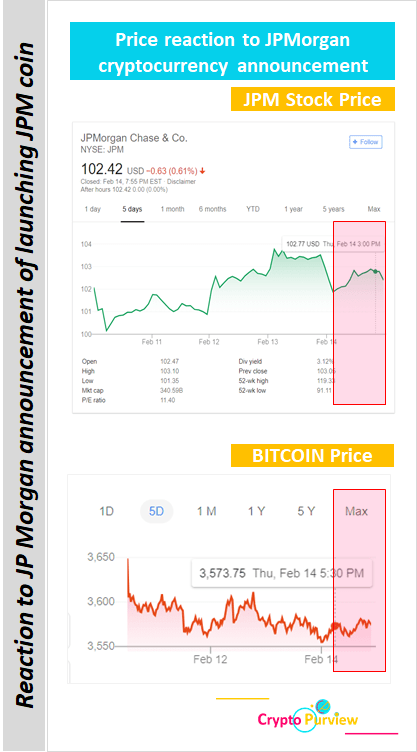

The announcement received a mixed reaction from the crypto community. For some, this confirms institutions are interested in crypto and so bullish long-term for the asset class, but many argued whether JP Morgan really needs to create their own cryptocurrency.

Some popular remarks:

“A blockchain is designed to be decentralized, so no one party has control over transactions being sent over the network. This is the opposite of the JPM Coin concept”.

“JP Morgan thing is long term a positive thing for Bitcoin. Let them play around with their stable coin, once we get more mainstream the “cryptocurrency infrastructure” already sort of exists. ” – WhalePanda

“It doesn’t even need a blockchain at all because JP Morgan runs it. They could do it on a website and database they run” – David Gerard, author of Attack of the 50 Foot Blockchain.

“It isn’t like Bitcoin that aren’t under anybody’s control – it’s a centrally controlled thing that sounds vaguely like crypto-currency.”

“Why come-up with own crypto”, Why they don’t just use XRP”

Use scenarios:

Following are the applications for the JPM Coin.

The first is a real-time settlement. Currently, the large corporate client’s international payments happen using wire transfers which takes more than a day to settle because of different cut-off times, time-zone differences etc. Use of JPM will allow real-time settlement and less involvement of the bank resulting in cost-savings and efficiency. The benefits would be extended to the end customers.

The second is for securities transactions – “Debt Issuance on a Blockchain”. In doing so, it would reduce the fees for clearing and settling. This was tested last year in 2018 where National Bank of Canada with the support of J.P. Morgan issued a USD 150 Million one-year floating-rate Yankee certificate of deposit.