Cryptocurrency exchanges typically employ a business model of making a percentage fee on each buy or sell order. The fees which is paid in crypto or fiat is deducted before each trade is executed.

Transaction Mining cryptocurrency exchanges flips this business model on its head. They too collect buyer and seller fees but they refund all the paid trading fees back in the form of their native exchange tokens. This creates a net zero trading fee for traders and incentivizes traders to join their exchanges.

The more they trade, the more cryptocurrency exchanges have to pay out in equivalent exchange native tokens. These tokens usually have some holding incentive such as special voting rights for ICO listings or receive a portion of the exchange revenue. Traders can either sell them on the exchange or hold their token for price appreciation.

Transaction Mining Exchanges such as Coinall, Bgogo, FCoin, and ZBG have leaped from relatively unknown exchanges to consistently ranking on top 25 exchanges by reported volume on CoinMarketCap.

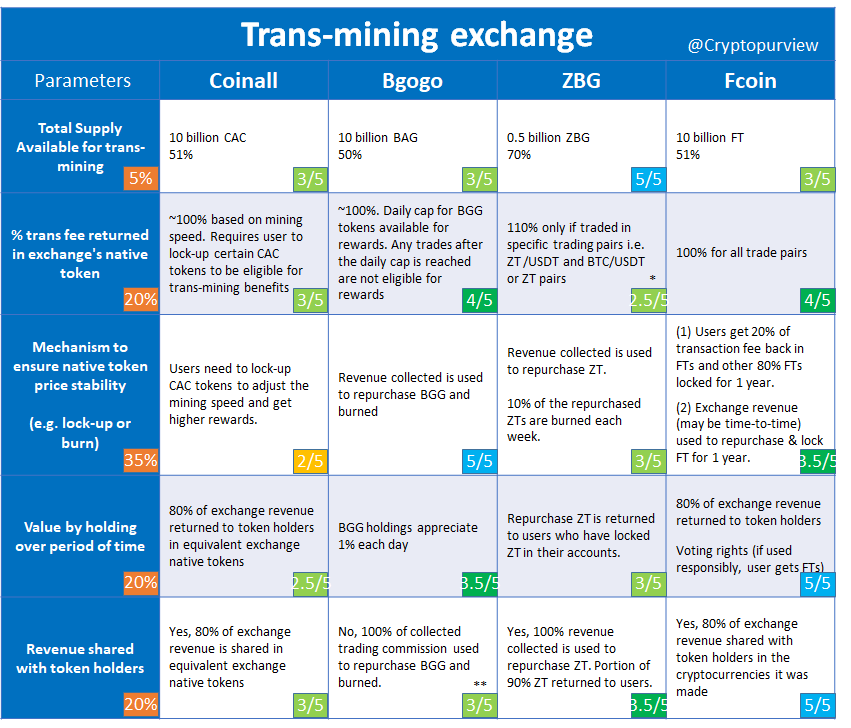

Business model comparison of top 4 Trans-mining exchanges (by trading volume):

** Rating increased due to buyback and burn process. This puts check on inflation and appreciates token value.

FCoin (4.13/5) leads the rating for the trans-mining business model followed by Bgogo (4.05/5). Although it implements a winning-model, FCoin was not always this successful. They recently made a lot of changes (using trial and run) in their trans-mining model to ensure a better ‘FT’ price stability.

Though the impression of zero transaction fee may create organic trading volume, the danger, however, is that these transaction mining exchanges unintentionally invite traders with trading bots to flock the platform, in order to benefit from net zero trading fees.

One might suspect such exchanges to be heavily involved in the wash-trading, however, given the circumstances and their disruptive model, we should not rule out the fact that it is users’ behavior (and not the exchange) that leads to multiple trades, as they benefit from frequent buying and selling at nearly the same or higher price. They may achieve this purpose through the use of trading bots.

When it comes to wash-trading exercised by the cryptocurrency exchanges, they largely do this to manipulate the price or give a false impression. Following two cases help to understand this more in depth.

1. Purpose of price manipulation: Exchanges take a certain portion of tokens as a listing fee from project owners. Then at the start of trading, they start wash trading to give the impression that the new trade pair and token is popular in their exchange and therefore, users get to their exchange to buy the tokens. When they join, the exchange starts dumping the coins on these users.

2. Purpose of giving a false impression: Exchanges also do wash trading to show the popularity of their exchange so that they can wrongly command a higher listing fee from new ICOs or crypto assets.

Now after establishing the likely purposes behind wash-trading, one can evaluate if trans-mining exchanges are indulged in wash-trading.

An example of a wash trade is having an account A set a Buy for 1 BTC @ $7,100 while Account B sets a Sell for 1 BTC @ $7,100 and once the trade settles they reverse roles and B sells back to A for virtually the same price.

Case 1: Exchange benefits by giving the false interest of trade-pair in their exchange.

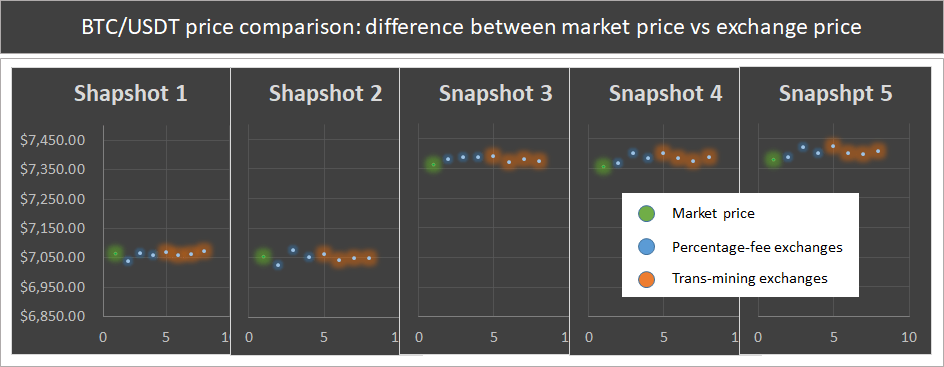

They use wash-trading to show the higher/lower price of a popular cryptocurrency asset in their exchange compared to the market price. For example, the BTC/ USDT pair has an average market price of $7,100 whereas in their exchange the BTC/ USDT pair has a price of $7,300. This creates a rush among traders to flock to these exchanges with their BTC and start trading there.

Based on the snapshot on 5 different occasions, we find that pricing of popular assets like BTC in trans-mining exchanges comes closer to the market price than what other popular exchanges like Binance or Kraken reflect. Therefore, we could assume that trans-mining exchanges do not run wash-trading for the purpose of price manipulation.

Case 2: Listing fees in cryptocurrency exchanges are big business.

By faking trading volume to be as big as other legitimate exchanges, exchanges set high prices for listing a new crypto-asset. But for this, they have to do it for most of the coins which are listed on their exchange.

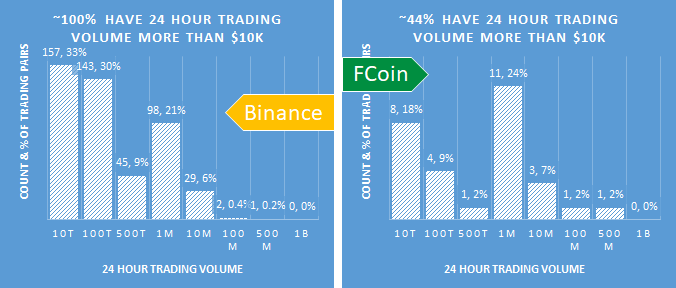

As seen in below chart, when comparing a percentage-fee based exchange like Binance, nearly 100% of the trading-pairs have a 24-hour volume more than $10,000, while trans-mining exchanges have close to 40-50% trade pairs with more than $10,000 24-hour trading volume.

Vs

in trans-mining exchanges, the top 5 pairs contribute 80-90% of the trading volume.

Since in transaction mining exchanges, users get paid in native tokens to trade more, they prefer mostly to pick popular, safer liquid assets like BTC, ETH, LTC, etc where they can perform quick buy and sell. Therefore, only the top 3 or 5 trading pairs in trans-mining exchanges contribute the most to the trading volume.

As we see in most transaction-mining exchanges (FCoin, Bgogo), just 3 or 5 trade pairs have good volumes. So it’s unlikely that any new projects will choose trans-mining exchanges as their first listing unless there is any strategic partnership involved or free listing offer. So we can safely assume that trans-mining based cryptocurrency exchanges are not manipulating for the purpose to command a higher listing fee.

Case 3: Wash-trade to inflate volume and get noticed.

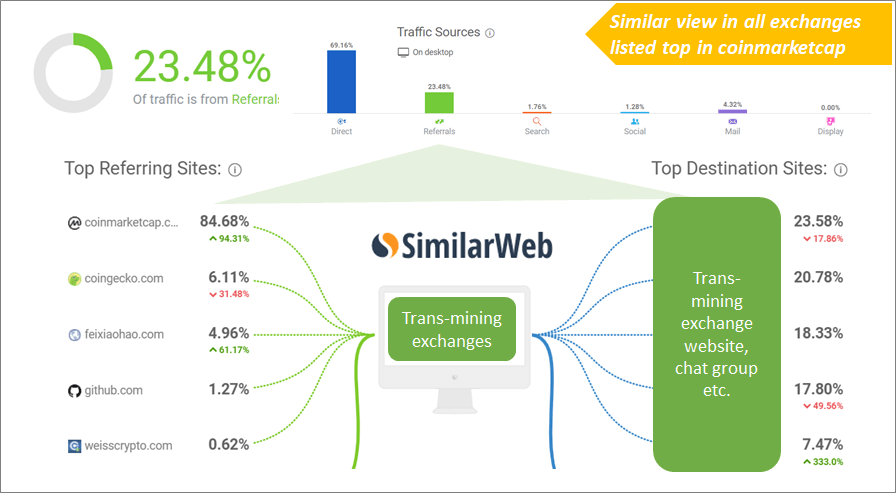

(a) The purpose behind that is to get top rank in Coinmarketcap, the web’s most popular cryptocurrency tracker website. This provides high visibility to the exchange. As seen from the stats of SimilarWeb, nearly 20% of the daily traffic in top trans-mining exchanges comes from Coinmarketcap.

It could be the likely scenario why trans-mining exchanges indulge in wash-trading, however, we should also not discredit the fact that since all exchange fees are refunded to the user, users are incentivized to trade back and forth in order to mine more coins, oftentimes with bots.

(b) Some projects use market-making services and bot trades to inflate their volume to maintain a minimum level of volume (say above $10,000) so that their listings remain active on certain exchanges. This does not seem to be a case in most trans-mining exchanges as there are trade-pairs with sub-below $10,000 24-hour trading volume.

Conclusion:

In most trans-mining exchanges, we see two probable causes for inflated volumes. Cause 1: Wash-trading (case 3(a)) mainly to inflate volumes and get attention. Cause 2: Their disruptive model which incentivizes users to do multiple trades in their exchanges. It is difficult to separate out which one is the larger cause.

Exchange native token (and it’s business model) function as a central element in their exchange. If designed well, it continues to maintain stable growth. If not, an exchange ecosystem will be unstable and soon traders will lose interest. Based on our assessment parameters, FCoin seems to have the most effective business model for transaction mining.

NOTE:

(1) The business model scoring should not be considered as a recommendation for the exchange. Security has been the major issue in cryptocurrency exchanges. Last year alone, access of $1Billion worth of cryptocurrency assets were stolen. We can’t say if trans-mining exchanges are safer compared to percentage-fee based exchanges.

(2) We consider wash trading and volume faking to be a problematic feature of crypto markets.