CoinMarketCap moves away from volume. Introduces a new metric: Liquidity

Leading Cryptocurrency data provider, CoinMarketCap has launched a new metric – Liquidity to rank exchanges. Announcing the development on Nov. 12, CoinMarketCap sees its new metric ‘Liquidity’ to replace dependence on exchange reported volumes, which is often inflated from wash trading practices.

“We believe our adaptive methodology will make our metric very difficult to ‘game’ as orders would need to be placed close to the mid-price, or risk being counter-productive to the Liquidity metric scoring,” said Carylyne Chan, Chief strategy officer of CoinMarketCap in an inaugural conference in Singapore.

CoinMarketCap new Liquidity metric currently shows ranking for 53 exchanges (as of press time). The top 3 exchanges as per liquidity metric are Binance, HitBTC, and Huobi.

Drive for a new metric:

Given the unreliable volume data submitted from exchanges and hence, inefficient to use for tracking performance, Coinmarketcap since Q2 2019 has been preparing a new ranking method.

As part of their drive to account real trading data, in May 2019 Coinmarketcap asked exchanges to submit data such as live trading and order book data. The collected data then goes through several new data cleaning and verifications to ensure data integrity.

The new liquidity metric looks for factors like distance from the mid-price, crypto-asset order-book depth, etc. Calculations are made by collecting the data from exchanges at regular, random 24 hours time intervals.

What is Liquidity depth:

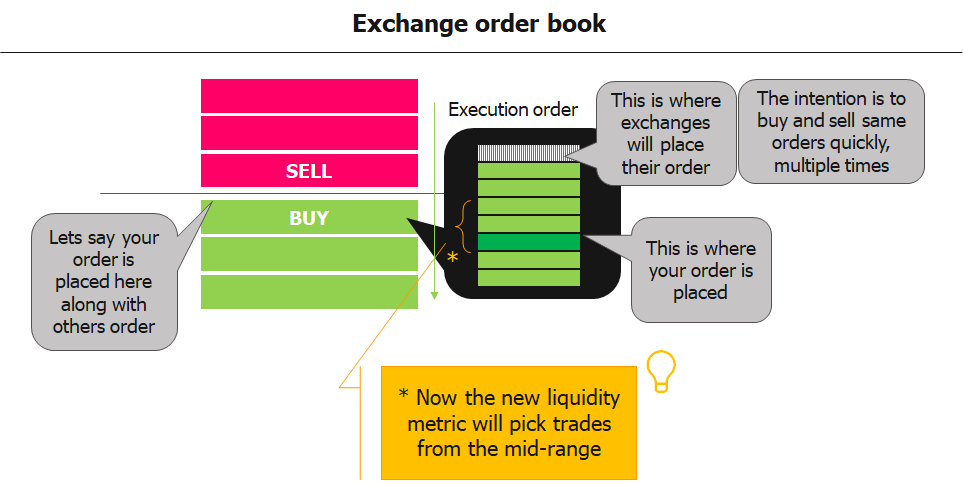

When orders are placed at a specific price point in centralized exchanges (spot & transaction mining), we see a cumulative order at that price point. By no means, we could know how far or near our orders are placed. For exchanges doing wash trading, they control the placement of the order and place their orders such that they get cleared first(or early) to minimize any possible risk.

With liquidity metric, now CoinMarketCap will look at random intervals the depth of the trade, mostly baseline their calculations based on orders placed near the mid-range. For exchanges who manipulate volume through wash trading to show that their exchange has high liquidity, they may not be able to take advantage as placing their orders near mid-range would expose their trades at risk of clearing the trade at a loss.

CoinMarketCap influence to control wash trading:

The purpose behind exchanges indulge in wash trading is to get top rank in the most popular cryptocurrency tracker website, Coinmarketcap. This provides high visibility to the exchange.

As seen from the stats of SimilarWeb (during Mar-Jun 2019), nearly 30%-40% of the daily traffic in lesser-known exchanges come from Coinmarketcap. All these exchanges had surprisingly high trading volume, mostly because of wash trading to get top ranking in CoinMarketCap.

Now by shifting reliance on volumes to liquidity, exchanges will have a hard time gaming the new metric in their favor and hopefully, disengage in wash trading practices. Note: the new adaptive methodology ‘liquidity’ is in the beta stage and yet to be applied in all CoinMarketCap tracking statistics.