Coinbase Acquires Xapo’s Institutional Custody Business

Coinbase Custody announced on Thursday, successful acquisition of Xapo’s institutional businesses. Xapo has long been a pioneer in the storage of crypto assets. Best known to house the vault in a decommissioned Swiss military bunker that offers uniquely robust protection against physical theft.

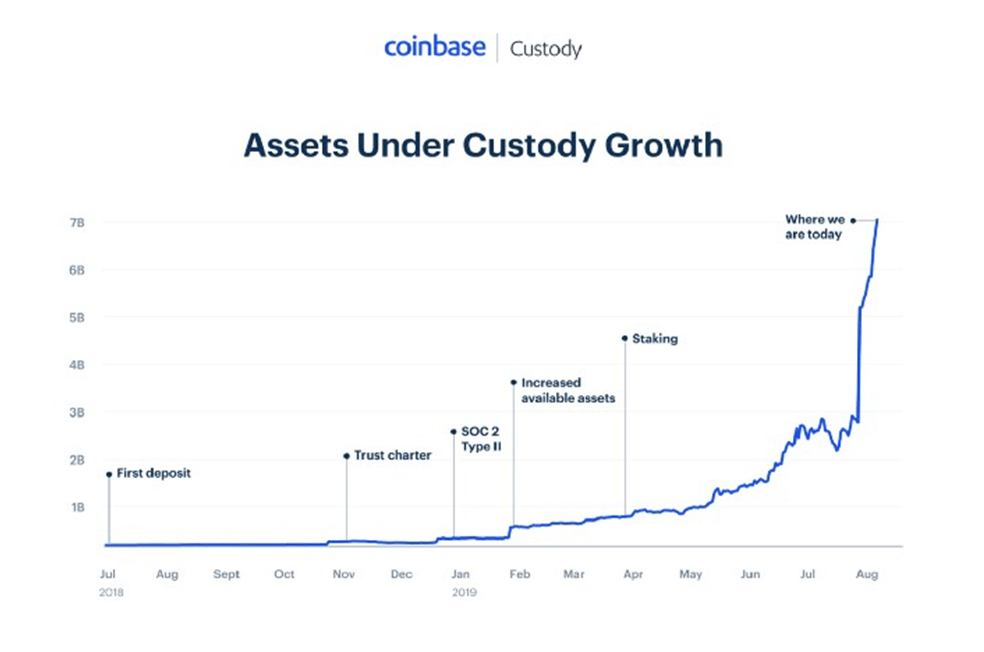

With this acquisition, Coinbase Custody has grown to over $7 billion in Assets Under Custody.

It now serves more than 120 clients in 14 different countries, making it the largest institutional custodian in the world.

According to Fortune, Coinbase acquired Xapo’s institutional business for $55 million after out beating investment giant Fidelity.

The report added that the majority of Xapo’s largest clients have agreed to transfer their assets to Coinbase, giving the company control of over 514,000 Bitcoins.

The remaining of Xapo customer accounts are reported to be worth over $3.5 billion. If Coinbase can sign on those as well, the company will have over 860,000 Bitcoins under custody.

What’s Next For Coinbase

Institutions adoption:

Today Institutional investors (investment funds, insurance companies, mutual funds, and pension funds) serve as major collectors of savings and suppliers of funds to financial markets. They are not going to make cryptocurrency investment decisions without some assurance that their funds are safe and secure.

Coinbase bridges this gap by providing a trusted choice for institutions to store cryptocurrency that meets regulatory requirements and assets are fully backed by insurance syndicate led by Lloyd’s of London.

This will lure investors that have till now been wary of adding crypto to their portfolios. [inlinetweet]In future Coinbase will offer its customers ways to monetize these crypto-assets by lending crypto to trusted counterparties.[/inlinetweet]

Coinbase Custody’s CEO Sam McIngvale said, “Fundamentally, we have to help our investors earn a return on their assets. You can imagine lending out Bitcoin and earning interest on that.”