CME Group to Launch Bitcoin Options in Q1 2020

CME Group, one of the largest derivatives exchange announced it will launch options on its Bitcoin futures contracts in Q1 2020. The proposal is pending regulatory review. By launching Bitcoin options, the company is providing its clients additional tools for precision hedging and trading.

“Based on increasing client demand and robust growth in our Bitcoin futures markets, we believe the launch of options will provide our clients with additional flexibility to trade and hedge their bitcoin price risk,” said Tim McCourt, CME Group Global Head of Equity Index and Alternative Investment Products.

Tim McCourt added that the new products will help institutions and professional traders to manage spot market bitcoin exposure, as well as hedge Bitcoin futures positions in a regulated exchange environment.

Demand for Bitcoin Futures contract

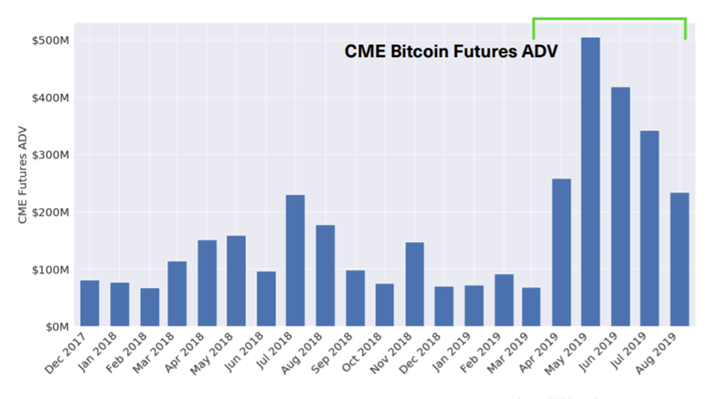

In August 2019, the CME exchange had the average Bitcoin futures daily volume of $234,385,300, which according to Bitwise is significantly large in comparison to the average daily volume of the ten largest Bitcoin spot exchanges.

Since its inception, 3300 individual accounts have traded Bitcoin futures in the CME Exchange.

In recent months, CME has witnessed nearly 7,000 daily Bitcoin futures contracts (equivalent to about 35,000 bitcoin) traded in the exchange and more than 3,300 individual accounts have traded the Bitcoin futures product since its launch.

In the Bitcoin futures space, last month Bakkt received clearance from regulators to launch Bitcoin Futures. The contracts will be physically-delivered to clients in Bakkt Warehouse, in contrast to the cash-settled Bitcoin futures offered by CME.