Bitwise New Research Suggest Bitcoin Market Has Materially Improved

Bitwise Asset Management Bitcoin ETF proposal submitted in Jan 2019 is awaiting for SEC final decision on 13th Oct. SEC has postponed several Bitcoin ETF proposals in the past and recently, SEC Chairman Jay Clayton in an interview with CNBC said that concerns remain on lack of safe custody options and the threat of Bitcoin price manipulation in unregulated exchanges.

Earlier this month, VanEck-SolidX withdrew its Bitcoin ETF application just a month before the scheduled SEC’s decision date. This has not slowed down Bitwise and the firm is determined to answer all hard questions of the SEC.

Bitwise has pitched a new research report to the SEC commission staff Jackson, Peirce, and Roisman. The report highlights that the “Bitcoin market has materially improved and become efficient“.

As per the Bitwise presentation on Bitcoin market to SEC commission staff,

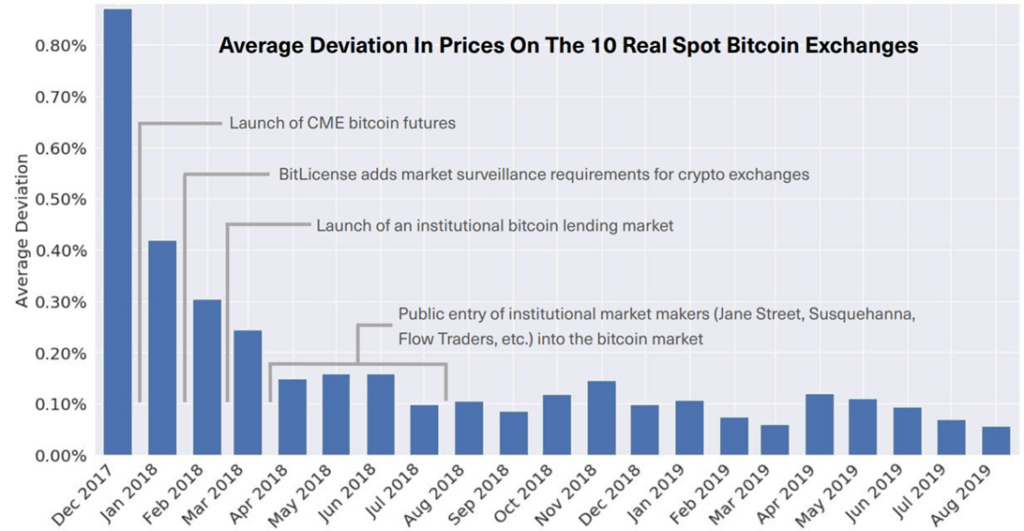

- The average deviation in prices on the 10 real spot bitcoin exchanges has significantly reduced indicating tight arbitrage. Note: Bitwise’s Bitcoin ETF proposal is based on using weighted-average of price from 10 large exchanges to accurately discover Bitcoin net asset value.

- These 10 exchanges are Binance, Bitfinex, bitFlyer, Bitstamp, Bittrex, Coinbase Pro, Gemini, itBit, Kraken and Poloniex. Except for Binance, all others are registered as a Money Services Business with FinCEN.

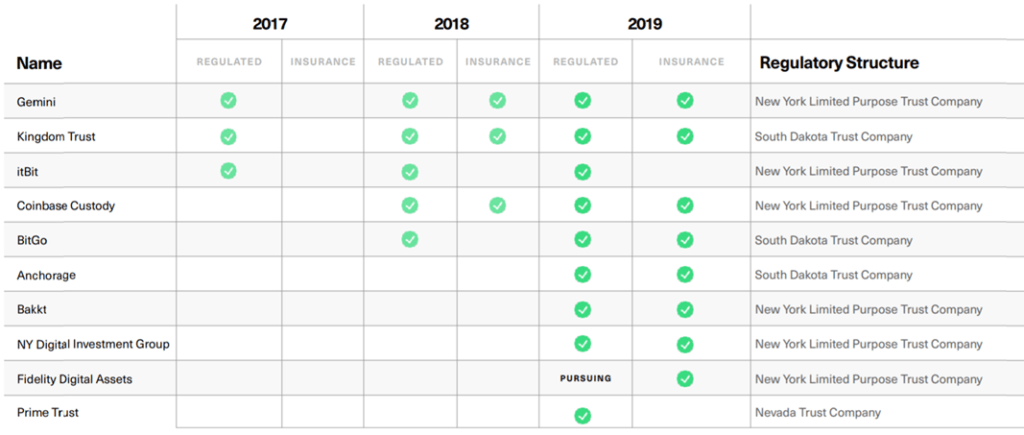

- Bitcoin custody has become fully institutional. Firms are increasing measures to provide safe custody services and also have insurance coverage against theft, loss, etc.

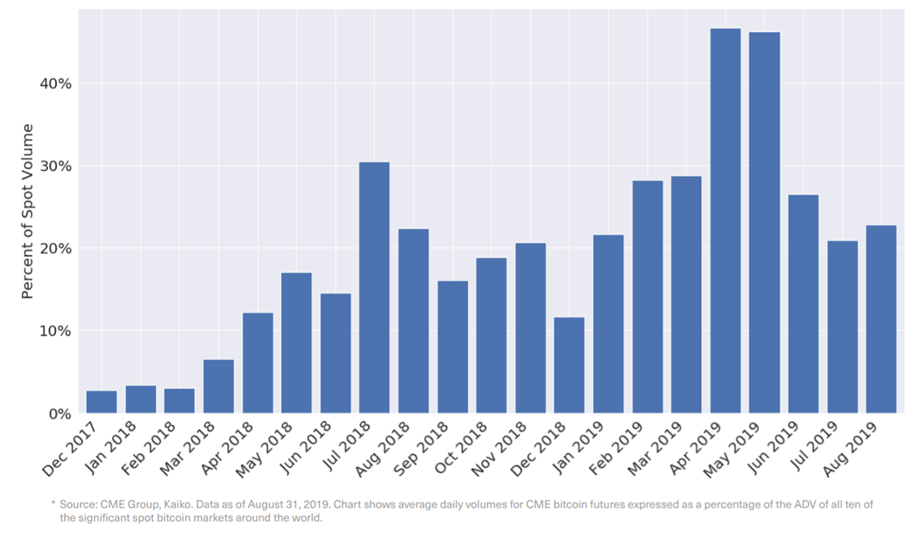

- The futures market has grown in regulated exchanges and represents a significant portion of the real overall Bitcoin market. For instance, in CME exchange, the average daily volume for bitcoin futures in August 2019 was $234,385,300.

Since Bitwise’s previous study report on fake Bitcoin trading volume, the market has matured. For instance,

- Coinmarketcap is preparing a new ranking method that excludes the inflated volume from exchanges.

- Increase in Institutional-grade custody solutions.

- Exchanges are taking measures to limit wash-trading. In the Bitwise new report, the firm mentioned that as many as 9 Crypto exchanges have reported more than a 90% drop in trading volume.