Bakkt prepares for a cash-settled Bitcoin futures contract

Bakkt prepares to offer cash-settled bitcoin futures. Bakkt announced the development in a press release issued on Nov 21st. The new contract will be listed on ICE Futures Singapore and cleared by ICE Clear Singapore, which is regulated by the Monetary Authority of Singapore.

Bakkt wants to set itself apart from its rival CME who currently leads the institutional-driven cash-settled Bitcoin futures contract. The new Bakkt cash-settled Bitcoin futures contract will be listed on Dec 9th and available for investors around the world. On the same day (Dec 9th), Bakkt will also offer Bitcoin options to its investors.

CME is also working to launch a Bitcoin options contract. Currently, its application is pending regulatory approval and expected to launch by Q1 2020. CME launched its Bitcoin futures trading in late 2017. The launch during Bitcoin bull run and head start allowed CME to gain a large market share.

Competitor analysis :

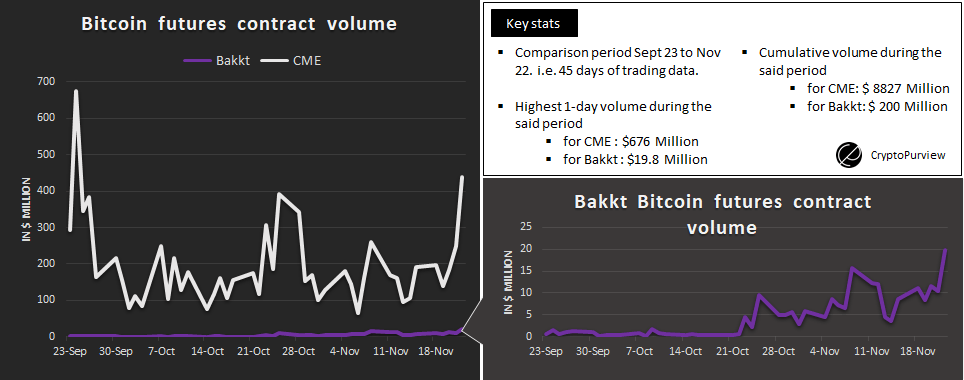

- Since the launch of Bakkt on Sept, 23, the platform managed a cumulative volume of $200 Million worth of futures contract i.e. an average of $4.45 Million per day over the last 45 days.

- CME during the same period had an average trading volume of $196 Million per day for its cash-settled bitcoin futures contract.

- CME’s highest 1-day volume during the compared period was $676 Million on Sept. 24, a day after Bakkt launch. Source: Skew database.

- Based on the current trajectory of volume growth in Bakkt, at this pace, it may take another 5-6 months for Bakkt to reach CME average daily volume. Study based on regression analysis (R-sqr strength: above 64%).

Bakkt highest 1-day volume was $19.8 Million on Nov 23rd.

Space to offer Bitcoin futures contracts to institutional investors is getting more crowded. ErisX and LedgerX are close to launching their derivatives products.

Increasing competition in Bitcoin futures offer and struggling to keep up volume demand, Bakkt cash-settled contract comes as a corrective measure to offer what institutional investors are used to dealing with – ‘cash’.

Bakkt existing futures contract is based on physically-delivered bitcoin which apparently is taking time to sit well with the institutional investors. Moreover, for speculators, physically-delivered Bitcoins are not profitable when Bitcoin is in the bearish zone i.e. continuing to drop.

Major institutional investors worries:

- Recently in a Q3 earnings call, ICE CEO Jeffrey Sprecher said that Bakkt is in talks with all kinds of financial institutions, including major banks and brokers who have shown interest and are having dialogs of where it fits, about regulation, etc.

Unclear regulations have been one of the reasons for major institutional players to invest in digital assets. Bakkt’s regulatory approval and image as a trusted advisor ticks the box.

- Another reason is the investor’s infrastructure readiness to invest in this asset class. For example, where to find trusted broker-dealers to buy contracts and settle delivered Bitcoins on-behalf of them, understanding Bitcoin and wallet use, etc. Hopefully, the move to add cash-settled futures contracts and options turn the tables for Bakkt.

Building worldwide Bitcoin exposure in a compliant manner:

Bakkt was created with a mission to expand Bitcoin access and exposure to the global economy in a compliant manner. As it is gearing to pick-up volume for the futures contract, Bakkt has also opened-up its enterprise-grade custody service.

Bakkt is also preparing to launch a consumer application and merchant portal in the first half of 2020. Currently, Starbucks is piloting the app. The application allows consumers to pay in Bitcoin and Merchants to instantly receive money in fiat currency.