In an era of technological advancement where the entire world is talking about the “Internet of Things” whereby we are expected to have connectivity between anything and everything, Currency cannot be left behind. Paper currency is bound to be a thing of the past. And virtual currencies will start taking over.

Governments and central banks around the world have been forced to spend trillions to save the economy during the coronavirus pandemic. This has convinced people that excessive money printing to cover deficits will see inflation in the future.

Bitcoin’s proponents have touted that prospect for years, and suggest Bitcoin use as a global reserve currency mainly because –

- It’s a capped supply, meaning only 21 million units will be ever produced.

- Its rate of supply is controlled through halving. The cryptocurrency experiences once every 4 years halving the rewards offered to miners of the network.

- And most importantly its peer-to-peer nature whereby transactions happen directly between participants, without the need for any intermediary to permit or facilitate them.

Case for Bitcoin – A global reserve currency

Ongoing U.S. dollar devaluation due to an increase in spending to keep the economy afloat. Bitcoin can challenge the U.S. dollar position as a world reserve currency.

Today Bitcoin (BTC) is already gaining momentum in global finance, including replacing main fiat currencies in the financial system, which is already facing challenges due to fear of inflation.

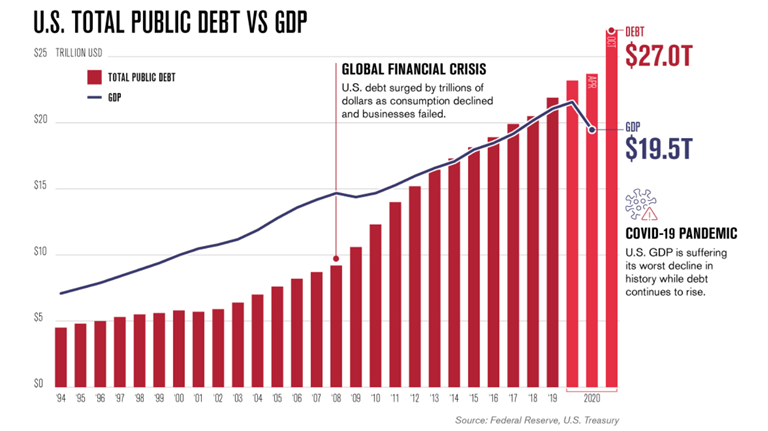

With financial havoc wreaked by the pandemic on the economies, governments and central banks have been forced to spend trillions to keep their economy afloat. In the U.S. alone, about 20 percent of all US dollars were created this year. This has lead to the fear of degrading the purchasing power of the fiat currency.

Visual Capitalist.

Visual Capitalist.Evolution from Gold to paper currency:

For most of the last two centuries, the world’s powerful currencies were convertible into fixed amounts of gold or other precious metals, and for thousands of years before that, many currencies were minted directly from gold or silver species.

The gold standard collapsed in most economies between the 1920s and 1970s, partly due to the pressures of financing two World Wars, but even more, because it appears worldwide production of gold did not keep pace with economic growth. Since then, nearly every major economy has issued paper currency, the value of which relies on the nation’s government or central bank will not increase the supply of new banknotes too rapidly.

USD as a world currency has survived for decades and continues to remain as the world’s reserve currency of choice due to no credible alternative. However, back in 2020, it became really apparent, given the incredible quantitative easing they were doing. Now given the influx of U.S. debt (currently at $27.8 Trillion), there could be ramifications for the strength of the currency and its position in the global economic environment can be challenged.

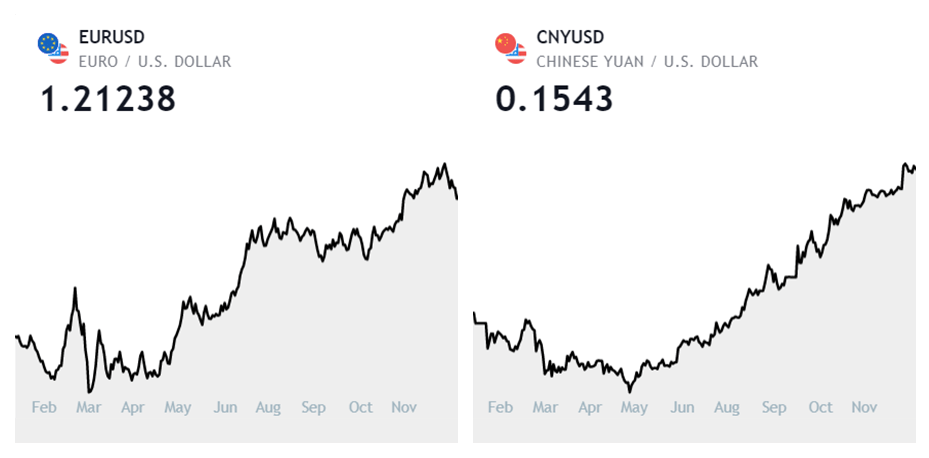

Of late, both the Chinese Yuan and Euro are challenging the USD in International Finance. However, neither Yuan nor Euro can compete strongly with the USD due to its valuation problems, i.e. Chinese Yuan is considered as undervalued (purposely done by the government as trade protectionism measures) whereas the Euro being as Overvalued.

Bitcoin as an alternate option for international finance

Leading Cryptocurrency, Bitcoin can overcome the challenges of both Gold standards as well as fiat currencies.

Bitcoin is well poised to achieve this feat. Bitcoin has a supply limit, whose rate of supply is controlled without any intervention from the government or any intermediate agency. The instability of the global economy and fear of large inflation numbers in the years to come has pushed many to consider Bitcoin as a hedge to economic uncertainty. Some of them include publicly traded companies:

- Square Inc., which allows users to buy bitcoin on its Cash App, bought $50 million worth of the digital currency in Oct 2020 to use as a hedging instrument in its corporate treasury.

- A massive influx of institutions such as MicroStrategy adding Bitcoin to their treasury. As of Dec 21, 2020, the company holds roughly 70,470 bitcoins, acquired at an average purchase price of approx. $16,000 per bitcoin, inclusive of fees and expenses.

- PayPal introduced a crypto service wherein U.S. customers can buy, sell and hold select cryptocurrencies directly through PayPal using their Cash or Cash Plus account.

Larry Fink, CEO of Blackrock – the world’s largest asset manager, with over $7 trillion under management – updated his stance on Bitcoin last month, now acknowledging its potential global relevance. In a conversation with Bank of England governor Mark Carney, he said: “Can it evolve into a global market? Possibly.”

Fink’s comments last month follow Blackrock fixed income CIO Rick Rieder’s comments, where he suggested bitcoin could eat into gold’s market cap. This positive, or at least warming, take from Fink is yet another in the list of large traditional money managers talking publicly and positively about bitcoin, including Stanley Druckenmiller, Bill Miller, Guggenheim Funds, and AllianceBernstein.

As well-known companies, institutional investors, and Wall Street billionaires are entering the market, their endorsement gave confidence to otherwise skeptical mainstream investors. Now investors are pointing out Bitcoin’s potential as an inflation hedge and the future of world currency. Recently, Stephen Harper, an economist and the former prime minister of Canada, said bitcoin could potentially see use as a reserve currency.

Regulator clarity:

Bitcoin by its very nature is not beholden to country borders or specific government agencies. This presents a problem to policymakers.

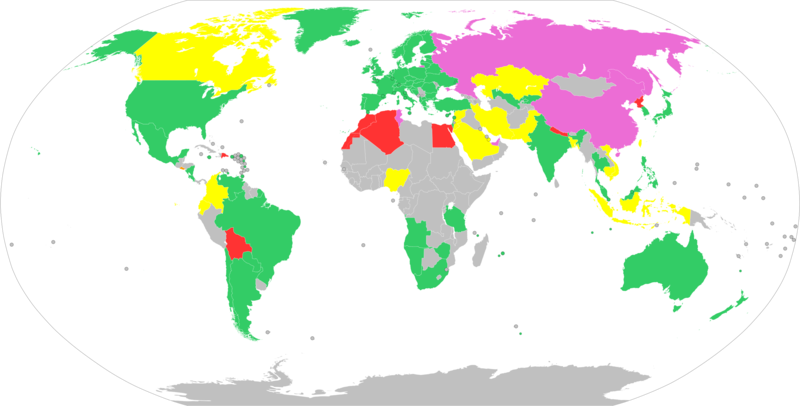

Bitcoin is explored by corporates, financial institutions around the world, and most importantly the regulators. Today, there is no consistency in the way various countries regulate Bitcoin – no uniform legal structure, accounting, tax, and audit-related standards. Thus, regulation has become one of the most debated issues.

The views of the major regulators like the World Bank and the International Monetary Fund on the position of Bitcoin are not consistent. In the U.S. alone the classification varies among the regulatory agencies – The CFTC treats bitcoin as a commodity while the IRS treats it as property.

GREEN: Permissive (legal to use bitcoin)

YELLOW: Contentious (some legal restrictions on usage of bitcoin)

PINK: Contentious (interpretation of old laws, but bitcoin is not prohibited directly)

RED: Hostile (full or partial prohibition)

GRAY: No data

Another concern of regulators has been – use of cryptocurrency for money laundering and illicit finance. However, data from Chainalysis suggest cryptocurrency-related crime still remains a small part (less than 1%) of the overall crypto economy. In comparison, the estimated amount of real-world fiat money laundered globally in one year is 2−5 percent of the global GDP, or in the range of US$800 billion to US$2 trillion.

The cryptocurrency dominance can be arrested any time the government decides to crack the policy whip. Both the UK’s Financial Conduct Authority and the president of the European Central Bank highlighted the need for more stringent regulatory scrutiny for cryptocurrencies, noting the extreme volatility and criminal activity often associated with the market.

With regulatory improvements, Bitcoin can be a serious contender to challenge USD’s role in global finance.

To sum-up:

Though today the degree of volatility and lack of regulatory clarity is off-putting some institutional investors, it’s difficult to ignore Bitcoin’s significance as an effective hedge in the current global economic crisis.

Bitcoin currently priced at $34,500 (as of this writing) has a market capitalization of around $645 Billion and continues to grow. Each day more and more believers are pouring money into the crypto market, increasing the demand for cryptocurrency. It has broken the previous all-time high set in 2017 and skyrocketing more than 300 percent compared to the 2020 start.

Article by Ashvarya Kharoo and Julia Beyers.